Physical Retail Is a Huge Opportunity for Nontraditional Payments

January 4, 2024

By: Tyler Brown

Cards and Digital Wallets

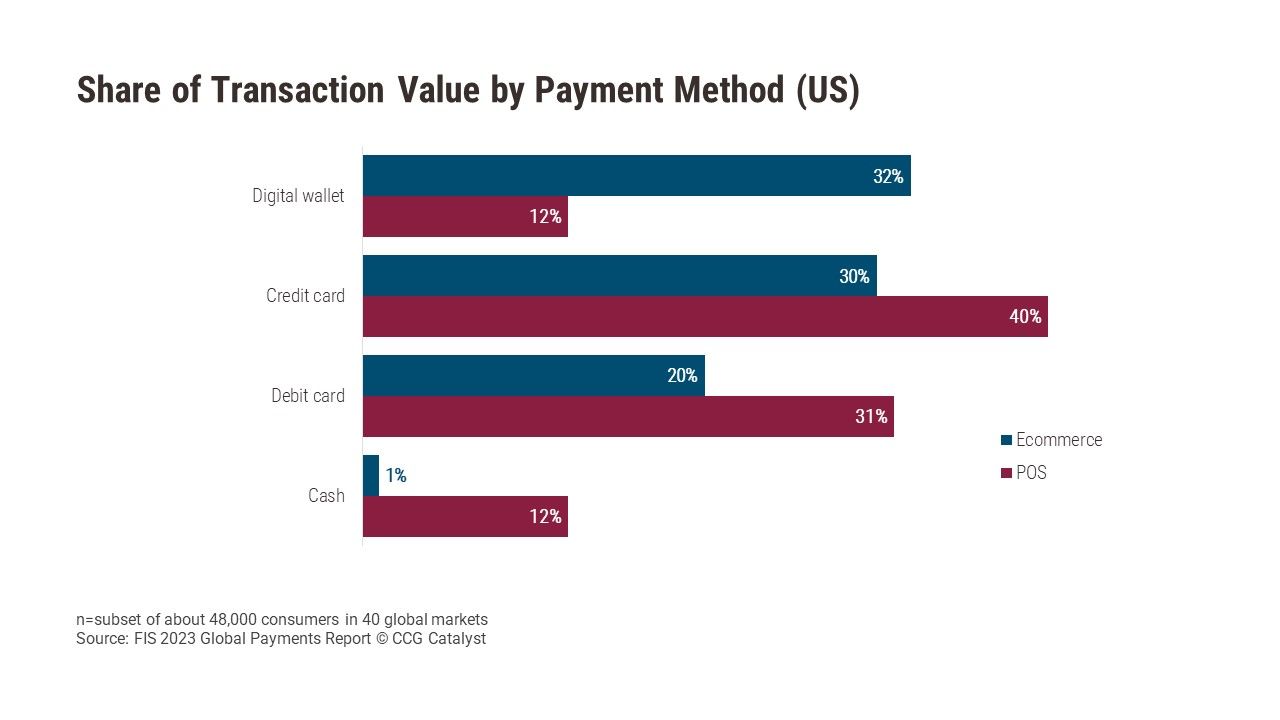

Digital wallets have been on the rise. Today, they edge out credit cards on share of transaction value in US ecommerce transactions, according to the FIS 2023 Global Payments Report (an estimated 32% vs. 30% of transaction value). They lag cards overall, which come in at a combined 50% across credit and debit, and they’re only a sliver of in-person transactions. But the dollar value in either case is huge: Ecommerce transactions for digital wallets added up to $540 billion and in-person transactions added up to $1.2 trillion.

Wallets aren’t playing a zero-sum game with cards. If credit and debit cards are the primary payment method embedded in wallets, network participants (issuers, acquirers, and card networks) can remain top of wallet — even if they give up a slice of interchange, and issuers relax their grip on the customer relationship. There’s also an inkling of a future for in-person payments in which cards are primarily device-based. Digital wallets do represent a competitive threat, though, especially if the consumer rarely thinks about whether they’re using a card, buy now, pay later (BNPL), or account-to-account payments.

This competitive threat can manifest in two primary ways:

- When consumers choose a primary payment method in the wallet that is different from a card, particularly a product a traditional issuing bank plays little or no part in. Apple Pay Later is an extreme example — BNPL financed by its own balance sheet and presented prominently as an available payment method in Apple Wallet.

- The share of mind controlled by the company that builds the wallet is a powerful competitive threat when the wallet provider also offers a payment product. Payments from cash balances in wallets, like PayPal or Apple Cash, may also erode cards’ share, and branded traditional credit products like Apple Card may do the same.

There’s a lesson in this trend for new entrants related to how they build and scale a product:

Digital wallets are examples of using a software platform to launch a new payment method (like PayPal on the internet 20-odd years ago) while expanding to physical applications when it makes sense based on available physical platforms. For PayPal, that first meant a debit card. For smartphone wallets, that actually meant working backward from the availability of phones to mobile commerce to physical commerce based on NFC-enabled devices.

Fintechs developing new ways to pay must keep in mind both the reach of the platform with merchants (online or physical) and how it fits into everyday consumer behavior. They also shouldn’t dismiss the value of in-person commerce, particularly given the ubiquity of mobile devices and how easy it is to build software for purposes the phone can facilitate. They may not be able to grow with physical commerce as much as ecommerce (projected by FIS to grow 4% annually through 2026 vs. 9% for ecommerce) but they have a much larger market to grow into.