Security, Legacy Systems Hinder Collaboration

September 8, 2021

By: Kate Drew

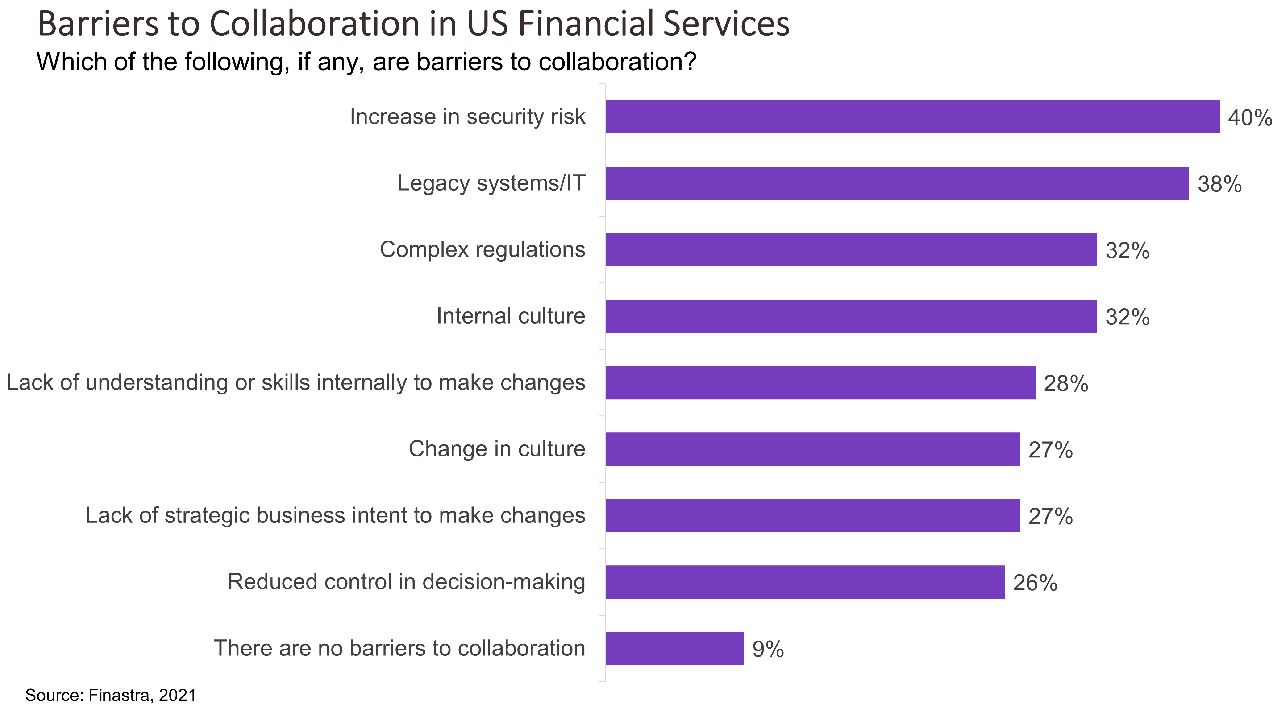

Collaboration in financial services is increasingly critical to survival. Banking institutions of all sizes are exploring how they can work with third parties to improve their offerings, with an eye, in particular, into turning fintech competitors into partners. However, there are barriers to collaboration that can make inking fruitful relationships challenging. According to a recent survey by Finastra, the top barriers hindering collaboration today are the potential for an increase in security risk, selected by 40% of respondents, and legacy systems/IT, chosen by 38%.

Concerns about security are understandable — in order to work with third parties, banks need to allow those companies to access their systems and data. Even with the most stringent due diligence and security protocols, this opens the bank up to vulnerabilities. Human error is a major factor in 95% of data breaches, per IBM, which means the more organizations (i.e. people) tied into the bank, the more risk there is. The best way to combat this is by implementing stringent third-party risk management programs that are designed to support a bank’s intention to make collaboration a strategic pillar.

Legacy systems, on the other hand, are another beast entirely. This is an issue that virtually every traditional institution today is facing, as most of their technology is decades old and not built to integrate easily. And, unlike security concerns, which are largely unavoidable to some degree, it’s a problem that is being dragged out by inaction. The hesitation is likely down to how gargantuan a task it seems to modernize a bank’s infrastructure. However, it’s time to get over the hump, and there are a couple of options for how to do that. The first is to work with your core provider — as we’ve discussed often, all of the leading providers in the US are building application programming interface (API)-based integration gateways to make collaboration easier, though they remain largely at the start of this journey. The second option would be to implement an integration layer at the bank either by building in-house or contracting with a managed service provider. Regardless of which path you choose, getting a strategy in place for how to overcome tech debt will be absolutely key to any collaboration efforts.

We’ve reached a point where collaboration is clearly the future. Nearly half of global financial services institutions surveyed by PwC say they have fully embedded fintech into their strategic operating model, and just 4% report having no strategy for fintech at all. Of course, there will be challenges. But these barriers can be overcome; organizations are making great progress every day. The important thing is to plan well and have a strategy in place that considers how the bank will tackle problems. Remember, these challenges are predictable, everyone is facing them. When you can see the roadblocks ahead, it makes it much easier to find a way around them. The real risk here isn’t in moving forward, it’s in not moving at all.