Digital Banking Experience Is Key Factor in Consumer Decisions

October 5, 2023

Digital Banking Experience

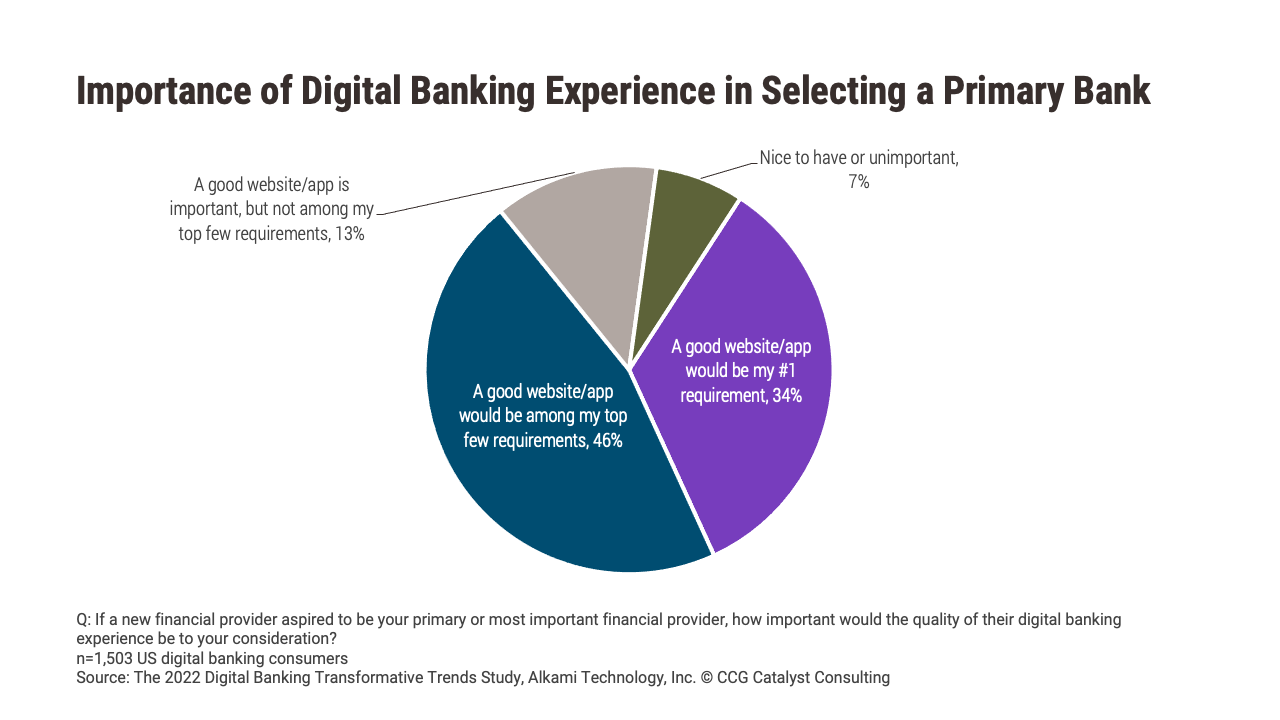

A good digital experience is not only table stakes for driving user satisfaction in banking, but also a key factor in winning new customers. Specifically, according to a recent research report from Alkami, 80% of US digital banking consumers surveyed said that a good website or app would be either in their top requirements for choosing a new primary provider (46%) or their #1 requirement (34%).

This is critical data at a time when competition for customers (and their deposits) is extremely heightened, and a majority of bankers believe it will intensify further. There’s also been some dramatic increases recently with regard to brokered deposit activity. Given this environment, bankers are looking with great fervor for ways to attract new interest and activity to their businesses. As such, Alkami’s findings reinforce a very important point — if you haven’t gotten your digital experience sorted yet, overcoming these current challenges is very much going to be an uphill battle.

The question then is, “What does a good digital experience look like?” Believe it or not, many banks are still struggling to meet customer expectations. Of course, there are a couple of things that are obvious like the ability to open accounts digitally or schedule payments. But beyond baseline capabilities inside an attractive interface, there’s a whole slew of options for what could go into a digital offering. A chatbot perhaps? And what about spend analytics? Don’t forget account aggregation! The possibilities are vast, leaving a lot of room for shiny object syndrome and making it difficult to take a strategic approach to designing the digital channel.

This is where banks need to focus on the concept of design. You are crafting something — think about making dinner, you want the perfect balance of ingredients that all fit together, not a hodgepodge of everything in your fridge. And taking that analogy a step further, you also wouldn’t go about making said dinner without thinking about what everyone else in the house likes. So, step one is to take a measured approach with restraint in mind. Then, step two is asking your customers what they want. Talk to them, survey them. Do Jobs to Be Done research on new demographics you’d like to reach. Get the data you need to make the right decisions.

Once you’ve done that, the last piece is to make sure you are doing all of this with enough flexibility (across people, operations, and technology) to support changing needs and new ones as they evolve. Because, after all, if there is one thing you can bank on, it’s that the future is a moving target.