Traditional Banks House Just Over Half of Consumer Funds

December 1, 2021

By: Kate Drew

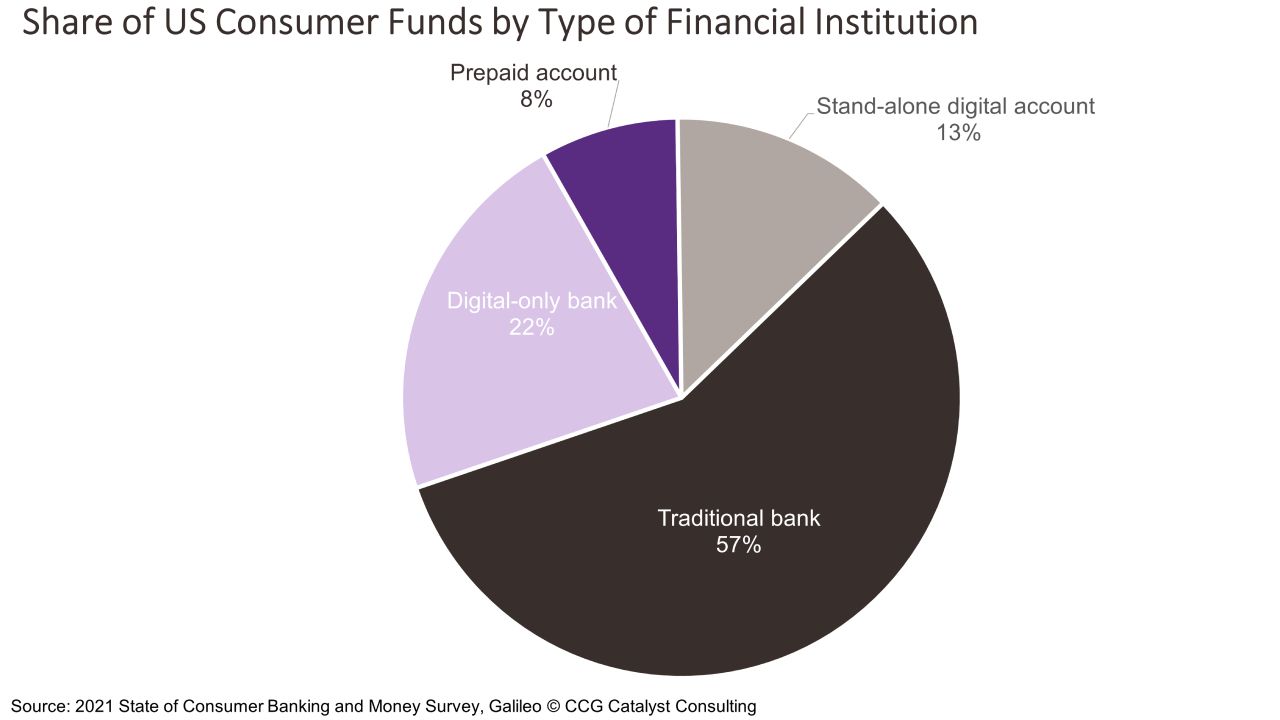

Nontraditional banking providers are siphoning funds away from traditional institutions. According to Galileo’s 2021 State of Consumer Banking and Money Survey, just 57% of US consumer funds are kept in traditional bank accounts, with nontraditional accounts like digital-only bank accounts or stand-alone digital accounts taking 43% collectively. This is despite the fact that the majority (77%) of consumers said that a traditional bank serves as their primary or secondary provider.

The dichotomy here is interesting because it suggests that, while traditional banks may still be seen as the main providers of financial services for customers, that doesn’t necessarily mean they are reaping all of the benefits of that position. This isn’t the first study to indicate that traditional institutions remain at the heart of consumers’ financial lives, and these providers probably take comfort in the many data sets out there that suggest they are still in the primary provider spot more often than not. However, if customers are starting to use more options — Galileo’s study found US consumers have an average of 2.5 providers — then their funds are spreading out across more companies. That means, over time, even taking the central role, the one that gets that coveted direct deposit, may not be enough to bring real value.

So, what is there to do? The answer is stickiness. That’s what newer providers like digital-only banks and fintechs are especially good at: Creating experiences that make the customer want to engage further, and thus move more money into their ecosystems. A great example of this is the company Acorns, which started out as a digital wealth manager focused on helping users save money by rounding up and investing their spare change. It now offers a debit account, as well. This enables customers that have gotten comfortable investing with Acorns to easily move over more funds and start spending with them. Slowly, the company has been able to pull in more and more of their customers’ overall net worth through this strategy. Traditional institutions should be thinking about things the same way. They should be drilling deeply into what their customers need and delivering thoughtfully.

In banking, it’s clear now that leaving it at what everyone else has isn’t going to cut it anymore. Achieving stickiness with your customers means creating experiences and propositions that bring real value to their lives. Being considered a primary or secondary provider is great, but being the provider that can serve as many of their needs as possible in one place is what drives their money to you. Think, how can you add more value? What kind of products and services would complement your existing offerings? Really get comfortable with the idea that the right path may be different and unfamiliar. As we’ve said many, many times before, let’s think outside the box.