Synthetic Identity Fraud — A Growing Concern Among Financial Institutions

February 9, 2023

By: Kate Drew

Synthetic Identity Fraud and Financial Institutions

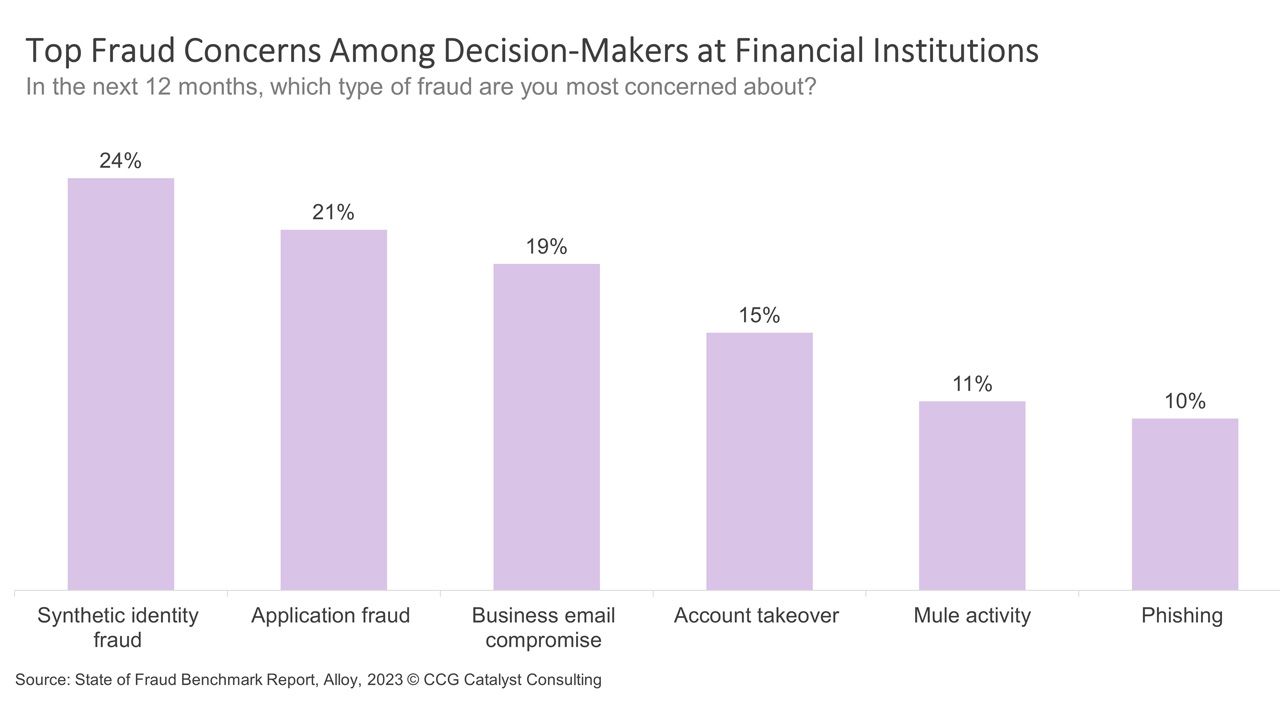

Synthetic identity fraud is a pressing issue for financial institutions (FIs). In fact, according to the State of Fraud Benchmark Report recently released by identity decisioning platform Alloy, it tops the list of fraud-related concerns among decision-makers at these organizations for the year ahead.

Synthetic identity fraud occurs when fraudsters combine real personal information with fabricated data to create a false identity and then use that identity to open financial products. Because legitimate data is used when building these personas, they can be difficult to flag during an application process. This is compounded by the fact that the Social Security Administration (SSA) began randomizing social security assignments in 2011, which has made it harder to determine whether a social security number (SSN) is fake. For example, according to LexisNexis, a synthetic identity “may have a real, “shippable” address and the SSN may appear valid, but the SSN, name, and date of birth combination do not match with any one person.”

This kind of fraud is particularly damaging to FIs because there is generally no other victim attached. Or, put another way, there’s no real consumer involved who can flag the fraud. As a result, these scams may go on for long periods before the FI catches on, allowing fraudsters to gain access to numerous financial services, including lending products that they never intend to repay, and leading to large losses for the organization. Per LexisNexis, “Fraudsters can use synthetic identities to keep accounts open for months-to-years, garnering credit line increases and improved credit standing, only to eventually max out the credit line and disappear without a trace.”

So, what’s an FI to do? The answer to that question, as with so many things, lies in data. If you’ve got sophisticated data collection and analytics capabilities, you can better spot inconsistencies in an identity and prevent fraud. When it comes to application processes, this is an exercise in balance — if you ask for too much information, you will create friction. The goal is to ask for as little information as possible and then validate that information across a number of high-quality data sources. Additionally, according to Aisana Nurusheva, product marketing manager at Alloy, companies need to share final outcomes data more openly — that is, the ultimate determination of whether a customer is fraudulent or not. One way, she said, that might take place is via a consortium, but more tactically, FIs should work with their vendors to compile and share this data to help them stay on top of fraud trends that they should be aware of or respond to.

In the end, this is really about data-sharing, integration, and analysis. The more data sources you can integrate to, and the more quality data you can access overall, the better positioned you will be as an institution to prevent this type of fraud. Importantly, though, FIs also need to be able to make sense of this data in order to put it to work, especially when it comes to leveraging final outcomes information for modeling purposes. As such, organizations should be looking at how they can layer more sophisticated analytics and decisioning tools on top of such data in order to gain the understanding and control necessary to combat this problem long term.