Bank Boards Still Have Room To Improve on Tech Expertise

November 16, 2023

By: Kate Drew

Bank Boards and Technology Expertise

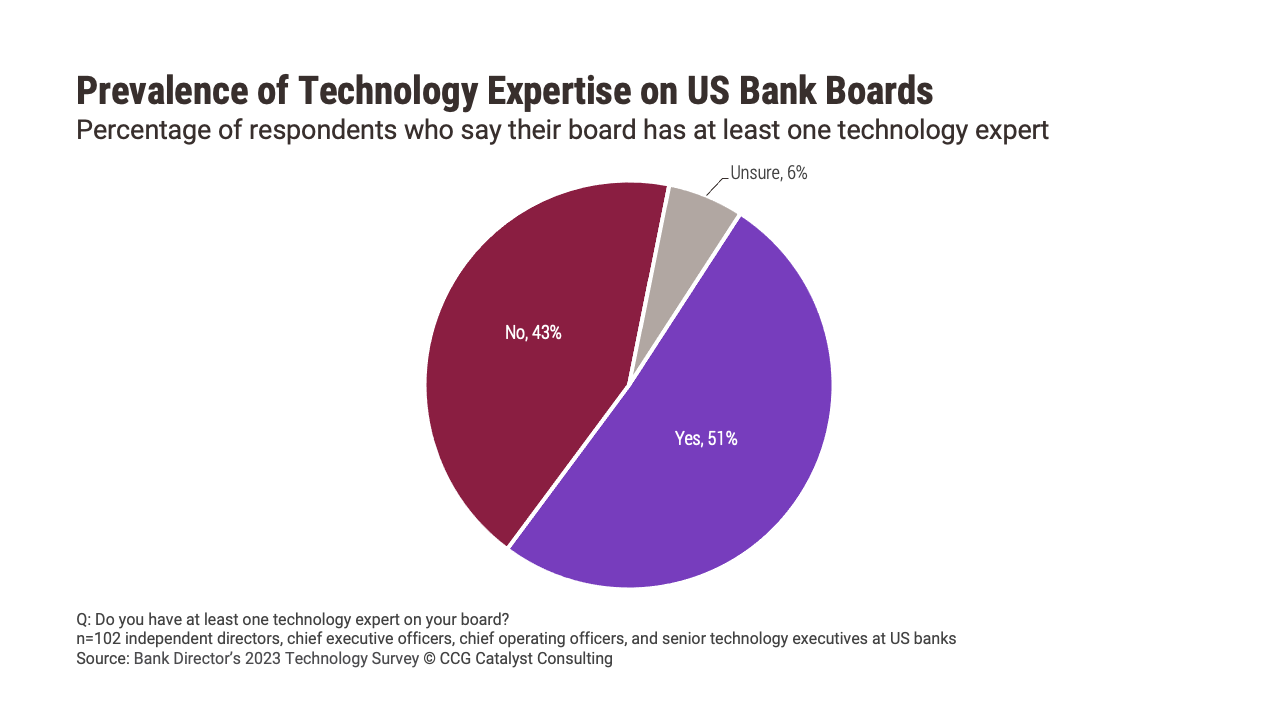

Bank boards in the US are improving on their technology expertise, but there remains quite a lot of room to run. Specifically, when asked whether or not their bank has at least one technology expert on their board in Bank Director’s latest technology survey, 43% of 102 executive respondents said no, which marks an improvement from last year when 53% said the same but still represents a fairly large portion of the group.

As we’ve discussed before, this is a gap that needs to be closed. Expertise to develop and execute on technology initiatives cannot just exist within a bank’s walls; it needs a counterpart at the board level that can speak the same language. That expertise is necessary to communicate value and build consensus — even if it’s just one person who can translate for the rest of the room. As Bank Director has pointed out in the past, while a bank’s board may not be directly involved in decisions about technology, it needs to be able to align technology with strategy and ensure that the necessary resources are available to achieve the organization’s goals.

This is all even more important now as we move beyond baseline technology discussions — think, digital banking, online account opening, etc. — and toward much more advanced areas like artificial intelligence (AI) and open banking. These are frontiers that are built on data and will require technical expertise in what it takes to support their development. An understanding of the importance of a well-defined data strategy and infrastructure considerations to underpin a bank’s broader vision will be key. A lot of that needs to come from the leadership team, but having similar knowledge at the board level can help to achieve critical alignment needed to make a real impact.

Overall, the data appears to be moving in the right direction. But, if you are a bank that falls into that 43%, it may be worth taking a closer look here. The speed of change is accelerating inside and outside of banking, and as such, there is perhaps nothing more valuable today than the ability to talk with someone who has at least a general understanding of how these new spaces are evolving. A deep AI expert may be a lot to ask for (they are rare); for most banks, even getting someone on board who can talk shop easily with your head of technology is likely to be tremendously useful.