The Challenger Bank Edge

August 18, 2021

By: Kate Drew

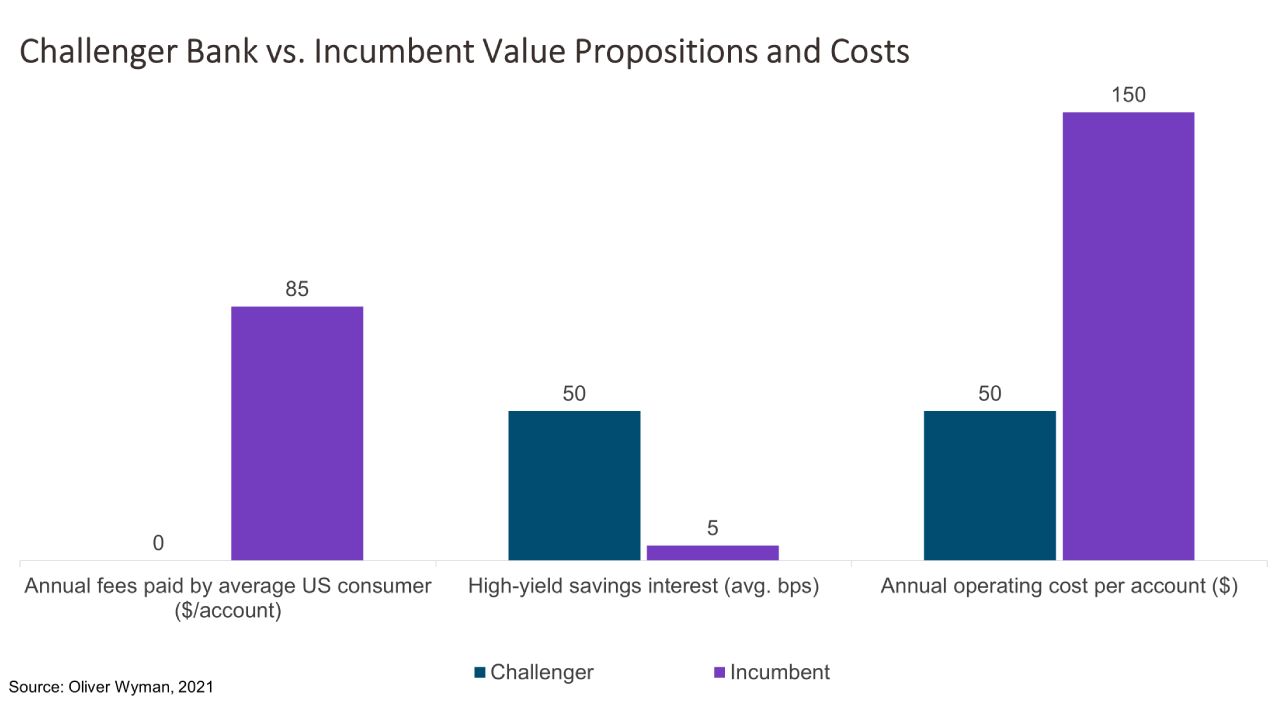

Challengers are coming for incumbents with a double-edged sword. According to data from Oliver Wyman, these popular new entrants are not only raising the bar on value and service offerings, but they’re also launching all of these features with substantially lower operating costs. For example, the average total in annual fees that a customer pays at an incumbent is $85, while at challengers, that number is zero. (Note: Oliver Wyman includes new entrants like Chime and Varo as part of the challenger bucket.) Meanwhile, average operating cost per account at an incumbent is $150 annually, triple the $50 challengers typically see. This sets up a dichotomy that puts incumbents in a tough position; how do they keep up without breaking the bank? (Literally.)

Digital challengers have amassed millions of customers with propositions like fee-free accounts and high-yield offerings. That, in turn, has pushed more established institutions to adjust their own offerings to better compete. For instance, these upstarts have largely done away with overdraft fees in their models — and, just recently, Ally Financial announced that it would follow suit, prompting a ton of discussion around whether this would become the norm. What’s often not discussed, however, is what enables newer competitors to offer such attractive products. Aside from substantial capital from investors and less scrutiny on their financial performance, challengers are operating on nimble technology (without tech debt) and lack the many inefficiencies that can only come from decades upon decades of experience. That’s given them a much more attractive cost structure. Unfortunately, for incumbents, this competitive edge will be hard to replicate, which means the new services and features they are compelled to offer aren’t likely to be all that cost effective.

The situation is a bit concerning, because, even with the cost picture as it stands, incumbents are still well behind challengers on things like fees. To overcome these hurdles, traditional banks are going to have to think outside the box. Creating more flexible technology infrastructure is a good first step, as it can help lower the cost of getting new features out the door. Additionally, the ability to pursue a best of breed strategy when it comes to launching new products and services will be key to remaining competitive and keeping costs in check at the same time. That means being able to use fintech offerings to serve evolving customer needs by plugging those services in to your own product suite. This requires flexibility, above all. As we’ve recently discussed, consumers want value for money, and challengers are pushing the envelope here. Incumbents need to think about how they can stay on top of changing trends, while still making money. These new value-propositions don’t have to be loss-makers; it will be hard to strike a balance, but it’s not impossible. For those willing to look at their infrastructure and plan for a future that doesn’t yet exist, there is opportunity.