Trust Still Reigns With Bank Customers

November 17, 2021

By: Kate Drew

Banking and Trust

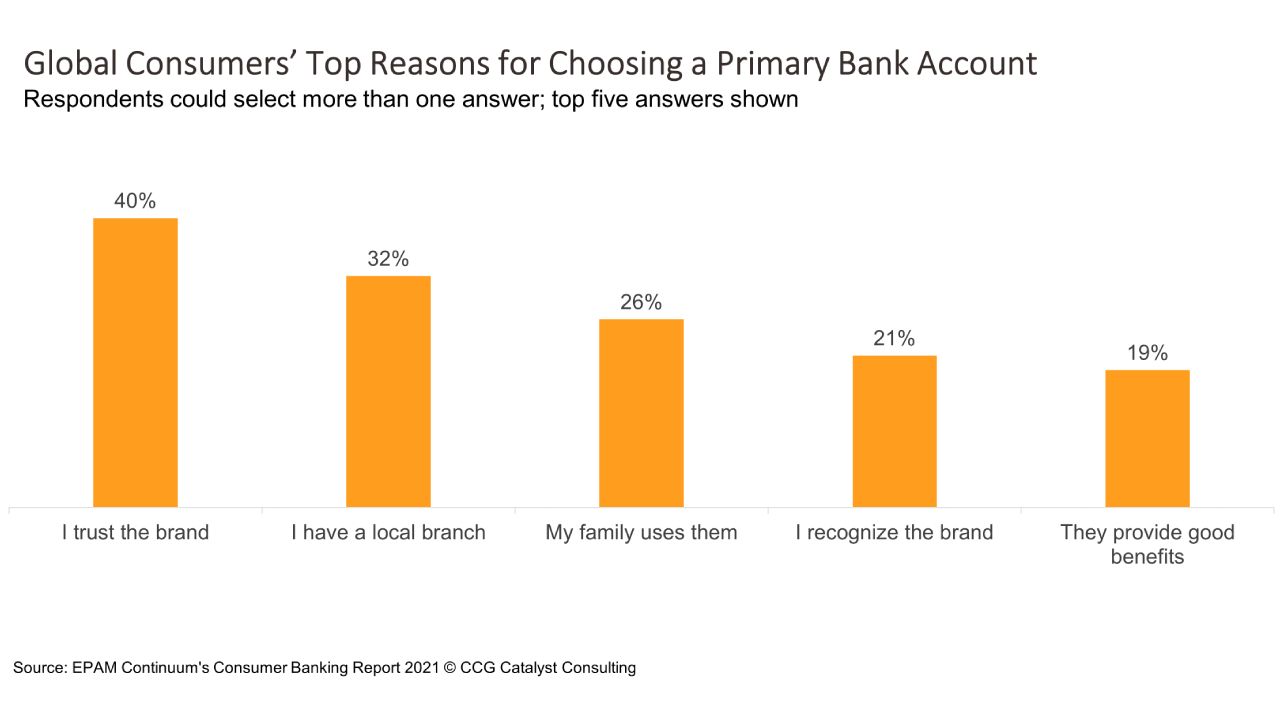

Brand trust is consumers’ top reason for choosing a primary banking provider. According to new data from EPAM, 40% of respondents globally said their trust in the brand influences their decision to go with a bank, making it the top choice selected, and signaling that, when thinking about the competitive landscape, we need to take a look back at the basics. While traditional financial institutions (FIs) have been scrambling to keep up on digital, which takes up most of the conversation today, the elements of trust and reputation are important advantages that should not be overlooked.

In particular, banking institutions can use their long-held reputations as stewards of customers’ financial assets to compete with newer brands that may have slicker experiences but lack the deep consumer trust that comes from decades of experience. In the same study, 49% of respondents said they would trust traditional financial providers to keep their money safe versus new digital financial companies, which pulled in just 16% of the vote. This suggests that there is a real opportunity here for traditional FIs to win over consumers by emphasizing their ability to provide security and peace of mind, especially during uncertain times.

The trick, however, is to combine this emphasis with digital tools that give consumers the convenience they are looking for. Customers today are influenced by all kinds of experiences in their daily lives — from Amazon to Netflix, and everything in between — which is changing their expectations when it comes to banking and financial services. But removing the human touch from financial interactions can also be scary. Banks are in a unique position to provide customers with the ease of digital they want today wrapped in a strong reputation built on trust.

This really comes back to two things: creating the experiences customers desire and marketing yourself effectively. Banks today have been focused on the former for quite a while. Though there is still work to do, customer experience is at least on the radar. When it comes to marketing, though, there is less chatter. And this is something new providers like neobanks are really, really good at. They may not have the reputations now, but they are certainly building them. As a result, brand trust may not be an advantage for established providers for much longer, making it important to double down before it’s too late. That means delivering on experience while also beating your own drum when it comes to the ability to keep customers’ money safe.