Mobile Banking Boosts Satisfaction Among Younger Users

November 3, 2021

By: Kate Drew

Mobile Banking and Satisfaction

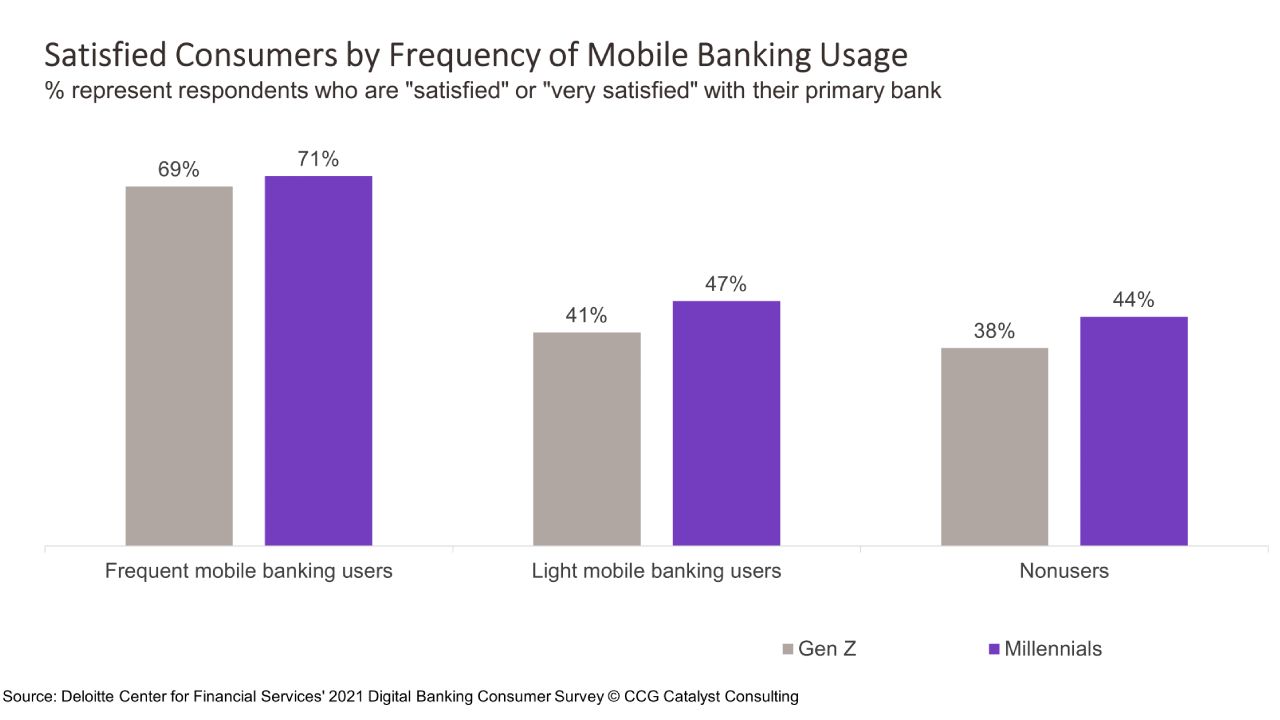

Mobile is likely the key to reaching younger generations — we’ve long suspected this. But getting these users onboard is about more than rolling out a mobile app; it’s about getting them to use it. In fact, new data from Deloitte shows there may be a real correlation between mobile use and satisfaction among younger customers. According to the company’s 2021 Digital Banking Consumer Survey, Gen Z and millennial respondents who reported being frequent or light mobile banking users were also more likely to be satisfied with their primary bank than nonusers. Specifically, 69% and 71% of Gen Z and millennial respondents, respectively, who used mobile at least once every two weeks in the last year, said they were either satisfied or very satisfied with their primary bank; that compares with 41% and 47%, respectively, for those using it at most once a month, and 38% and 44%, respectively, for those not using it at all.

Banks today spend a lot of time thinking about how to reach younger generations. This makes sense, as millennials and Gen Z are building wealth today and will make up a larger share of the workforce over time. In short, they are the future. And mobile is often at the top of the list when discussing how to bring them into the fold. But this data suggests there is more going on here — it indicates that satisfaction is tied to engagement. Getting users engaged is a lot harder than getting a mobile app in place. It requires thought, design and functionality choices, and hopefully, user research. Many banks don’t get this far in the mobile conversation, instead stopping at, “We offer this.” That’s a real mistake, especially as these younger generations are only going to become more important cohorts within the financial services ecosystem. The millennial generation alone is expected to increase its earning power by almost 75% in the next couple of years, according to The Economist.

This comes all back to user experience. Retail banking has become commoditized; we all know that. But younger generations have made it clear they aren’t going to stand for it. They’re flocking in droves to neobanks like Chime and Current that are putting customer centricity back at the heart of banking. As a result, traditional banking institutions are going to have to rethink how they approach their propositions if they want to win over these users. Elements like 2-3 minute account opening, budgeting tools, and slick interfaces driven by research-based design principles are quickly becoming the norm, as fintech competitors set new standards for service. Staying current here will require more than implementing an off-the-shelf mobile solution. It will mean looking for solutions that are extensible, that can be built on and augmented with new services and capabilities. Let go of the idea that everyone is doing the same thing; it’s simply not true anymore. Then, you’ll be well positioned to find out what works.