What Bank Execs Want From Their Core

August 11, 2021

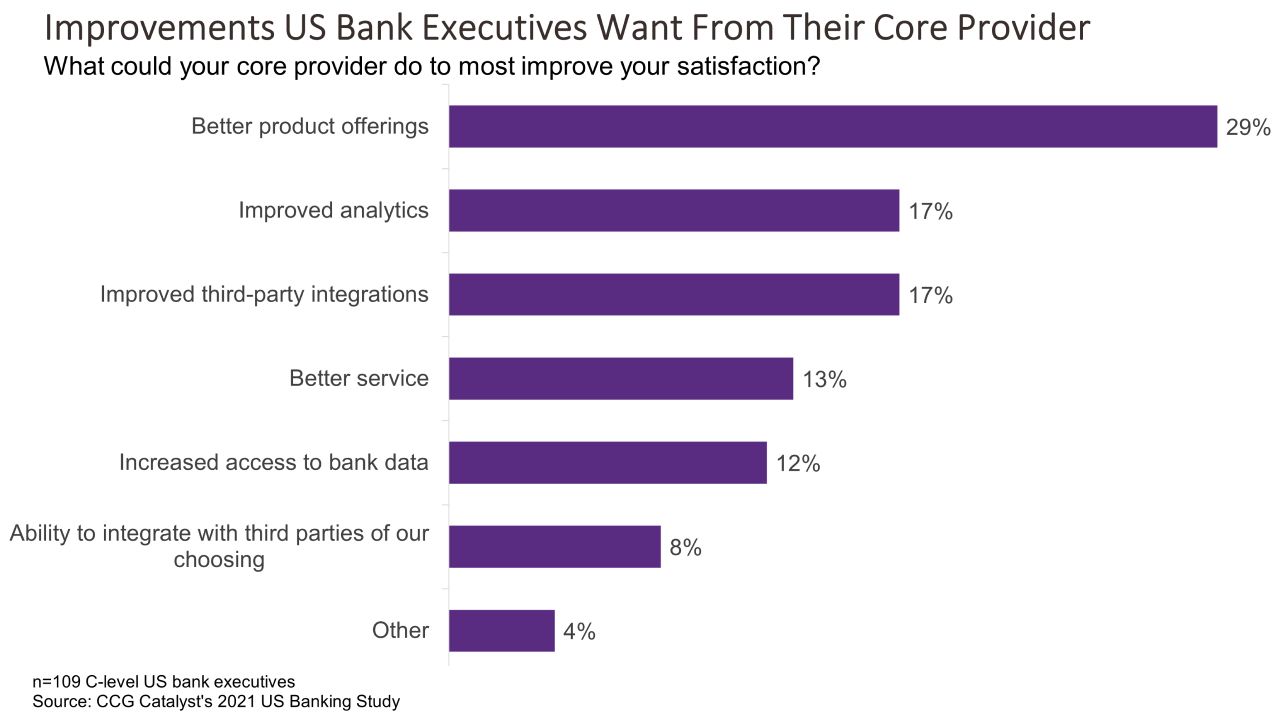

Banks are looking for better product offerings from their core provider. According to CCG Catalyst’s 2021 US Banking Study, 29% of C-level bank executives surveyed said their core provider could most improve their satisfaction by upping their game in this area, making it the top choice selected, followed by improved analytics (17%) and improved third-party integrations (17%). Banking institutions in the US have long relied on their core provider to help them with much more than their core system, and as we entered into the digital era, these companies became the de facto option for a slew of different capabilities related to digital banking, including online account opening, online banking, mobile, and more. That’s put a lot of pressure on firms that built their systems long ago, grew largely through acquisitions of other companies, and ultimately, now have to figure out how to create experiences that can compete with digitally native fintech entrants (which are building from scratch and largely in-house).

It’s not surprising that banks want better options — but perhaps their core provider is the wrong place to look. Many banks today take a best-of-suite approach to their infrastructure, looking at their core provider and compiling the worthiest of their offerings that will work for the bank. And then, they wait on their core provider to improve those offerings to give them more and better choices. But, if you’re really looking for improved choices, is that truly the way to go? Or does it make more sense to find technology providers that specialize in the areas you’re trying to solve for? The latter means looking at the market holistically and building an architecture around the leading solutions out there in a best-of-breed approach, rather than getting most things from a single provider. For example, dedicated digital onboarding solutions like MANTL and Terafina (now owned by NCR) are purpose-built and come with faster account opening times and reduced fraud rates compared with traditional solutions.

The elephant in the room here is integration — tied for second as the most-sought-after improvement our respondents are looking for from their core provider and a critical piece of the puzzle for anyone pursuing a best-of-breed strategy. That’s because, in order for all of the different solutions to work, they need to be able to talk to critical systems within the bank, and chiefly, the core. By this point, many technology providers have pre-integrated with a range of core systems, but that is still limiting in that it does not encompass the full spectrum of possibilities and is largely dependent on the core providers to determine which solutions are worth integrating with. Additionally, while the leading core vendors in the US are in the process of creating application programming interface (API) gateways to make integration easier for banks generally, they are largely at the start of this journey. As a result, forward-thinking banks are beginning to implement their own API layers that sit above the core. As we’ve discussed before, taking control in this way is likely the most viable path to accessing the full breadth of options the market has to offer.