What Fintech Partnerships Need To Work

January 25, 2024

By: Tyler Brown

Fintech Partnerships and Preparedness

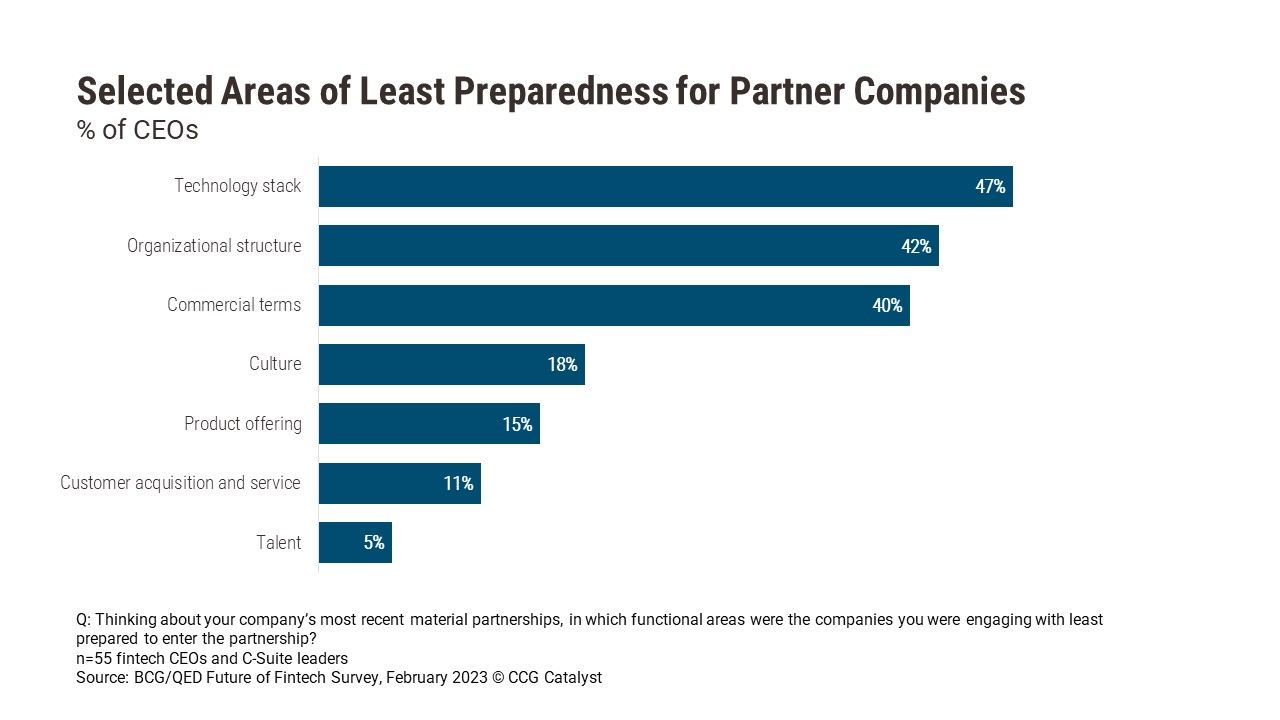

Fintechs depend on partnerships to successfully operate and grow their businesses (most pronounced in lending and infrastructure), according to a survey by QED Investors and BCG. However, these partnerships, which are often with traditional financial institutions (FIs), can bring a range of challenges, especially when it comes to how ready those organizations are to partner. Per the survey of fintech CEOs and senior leaders, the top two areas where partners tend to face readiness issues are related to their technology stack and organizational structure.

Forty-seven percent of respondents cited concerns about partners’ lack of preparedness with their technology stack, making it the top choice selected. This refers directly to an FI’s ability to integrate with a fintech and support its technology needs. Technological flexibility is an ongoing issue in banking and an imperative for any institution looking to keep up with the curve. Generally, achieving such flexibility means ensuring your tech stack is fully interoperable, either by implementing an application programming interface (API)-native core or middleware layer.

Organizational structure, meanwhile, was a close second in the survey, selected by 42% of respondents. While technology is an area that is often top of mind for bankers, the organizational changes needed in order to support fintech partnerships are less talked about. However, as we laid out in our 2023 report Successes In Transformation: Lessons From The Field, operational structure is extremely important to innovation efforts broadly, and that includes any fintech strategy.

There are few key components to keep in mind in building an organization prepared to partner:

- Organizing around focus areas. It’s important to have a strategy and work toward a common goal. The focus areas of that strategy should determine how the business is organized. For example, if a bank is looking to partner with fintechs as part of its wider roadmap, it may want to make sure it has a dedicated fintech unit to handle those operations.

- Hiring and communication. An FI needs people who understand the organization’s mission and objectives and can enthusiastically debate and embrace big ideas. That creates balance between a startup mentality and risk and compliance objectives, encouraging innovative ideas with appropriate risk assessment — an important element not only in active partnerships but in deciding who to partner with in the first place.

- Open-mindedness and a fail-fast mentality. People need the freedom to take chances on ideas that may not work out while testing, reevaluating, and implementing them in a structured way. A “chance” may be as narrow as a new product or as broad as a new business unit, like a group tasked with investing in fintech companies. This can be extremely helpful when trying to foster an organization capable of speaking the same language as potential partners.

Overall, the ability to partner well from an operational perspective may be an even bigger hurdle than the technical one because it is really about people. It speaks to the ability to structure, onboard, manage, and oversee those relationships. Therefore, for any FI developing a fintech strategy, it might be wise to make sure you’re putting an emphasis on how prepared your employees, operations, and institutional mindset are. With an organization that is set up the right way, FIs will be far better positioned to attract partners and benefit from lucrative arrangements. And, more likely than not, technological readiness will become easier to tackle.