Payments Head to the Cloud

June 30, 2021

By: Kate Drew

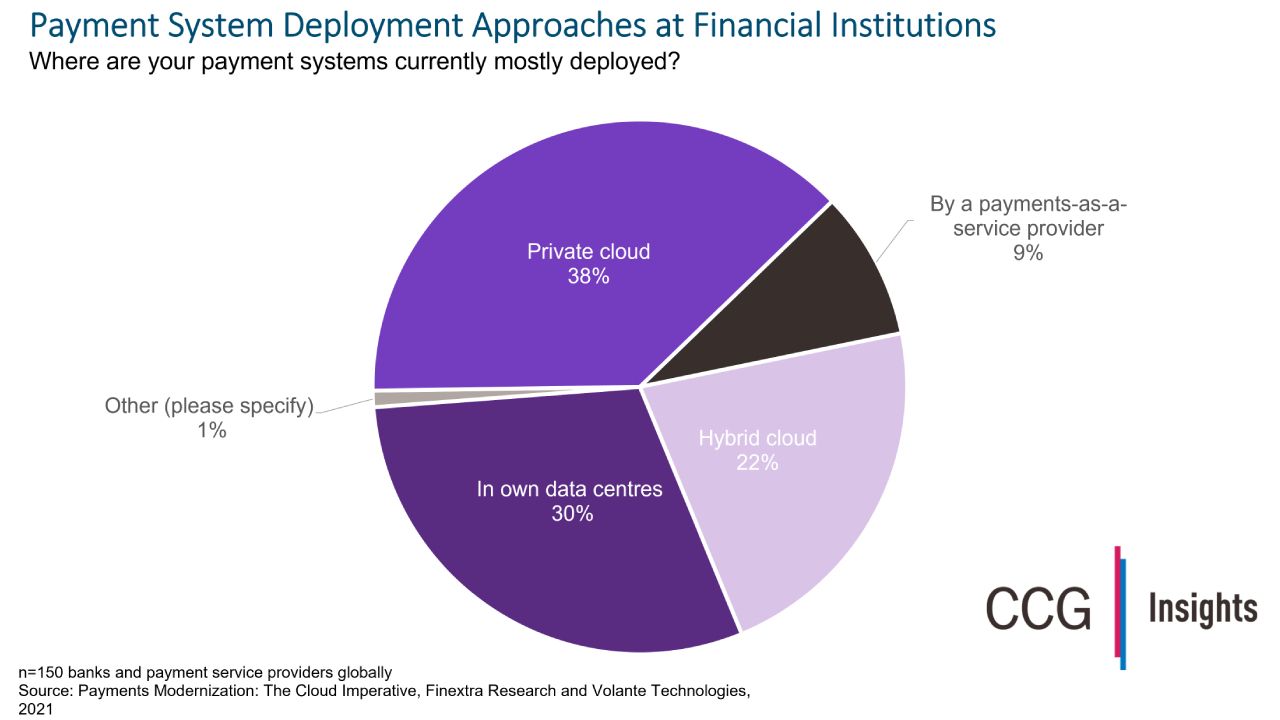

Payments are moving to the cloud. Gone are the days where that’s up for debate. In fact, according to a recent survey by Finextra in collaboration with Volante Technologies, 69% of banks and payment service providers surveyed globally are leveraging some kind of cloud infrastructure for payments. Of that group, 38% have opted for a private cloud environment, 22% are on a hybrid model, and 9% have enlisted a Payments-as-a-Service (PaaS) provider to manage the cloud deployment and connectivity of their payment systems. Based on this data, the “cloudification” of payments certainly appears set to become the new norm, meaning those that have yet to make the leap or even get a plan in place risk falling behind.

This shift to the cloud is part of financial institutions’ ongoing efforts to modernize their payments infrastructure in light of new competition from agile fintech players as well as the evolution industry standards — like the introduction of ISO 20022 and shifts toward real-time payments — that are demanding greater agility today. Additionally, banks by this point have had years to get comfortable with cloud technology in other areas — think Salesforce for CRM or Workday for ERP. Now, faced with the need to modernize their payment systems to keep up with industry and regulatory changes anyway, many are choosing the cloud as their next frontier for payments. With 70% of banking executives agreeing that modernizing payments is a core pillar of their digital transformation, according to Accenture, it makes sense that this would be another area in which banks begin to embrace the cloud and its benefits.

The question then becomes, “How?” It’s one thing to believe cloud migration is the right path, it’s quite another to get on the road. That’s largely because there are many different options that banks can pursue — private cloud, public cloud, hybrid cloud, PaaS. And, then, which providers to engage. These decisions can be tough, especially when the choice to move to the cloud to begin with might feel huge. The trick is to take a step back and think about what you’re trying to do. How much do you want to manage? How complex are your needs? Knowing what your requirements are is the first step. As with most things, the right choice will depend on the bank and its needs. For example, Finextra points out that, regional banks, which tend to have more complex requirements than community banks but lack the budgets of the big firms, make up most of the 9% of institutions opting for PaaS. Banks will need to carefully consider the options in front of them and weigh those choices against clearly defined imperatives. Rarely in financial services do we get a one-size-fits-all answer; this is no exception.

Subscribe to CCG Insights.