Bank Customers Are Spoiled for Choice

February 23, 2023

By: Kate Drew

Bank Consumers and Choices

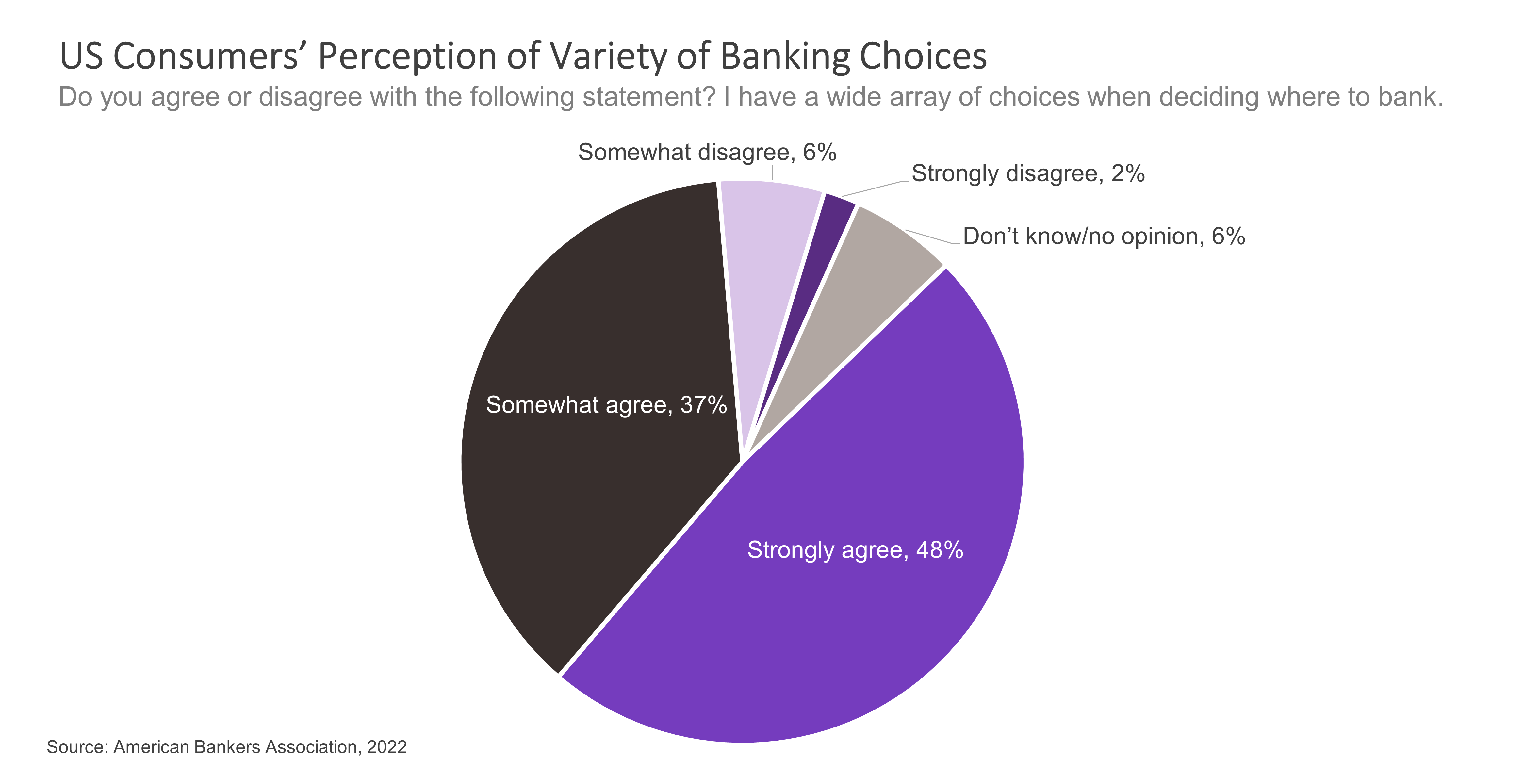

Consumers today have more choices than ever when selecting a banking provider. And they are well aware of it. In fact, according to recent data from the American Bankers Association (ABA), 85% US adults surveyed said they at least somewhat agree with the statement that they have a wide array of choices when deciding where to bank. Unfortunately, for traditional institutions, especially those that are having trouble staying on top of new trends in technology and innovation, that means one thing: competition. And that competition is coming from a range of places, from other traditional banks (large and small) as well as fintech providers and larger technology players that have been getting more and more involved in financial services.

Competing in such an environment is hard. It requires a thoughtful strategy that allows an institution to play to its strengths, while marrying those strengths with plans and investment for the future. But now is an interesting time — fintech took a hard hit in 2022, exposing weaknesses in fraud and compliance practices, and regulators are paying more attention. That presents an opportunity for traditional banks to step in and remind customers that they have a long track record of acting as stewards of their finances. The ABA survey also found that consumers trust banks (49%) more than anyone else — including healthcare providers (24%), nonbank fintech providers (11%), and the government (10%) — to keep their information secure and private.

This isn’t a new story, but it’s one worth reiterating in the current environment. If traditional players can up their game a little bit on the experience side, they will be very well positioned to endear customers to them while the fintech industry goes through these growing pains. This hiccup won’t last forever, so the time to get a leg up is now. And it doesn’t stop with consumers; as noted in another recent post by our chief strategy officer, Tom Godsey, the ability to cultivate trust across a range of relationships is of incredible value for a bank — for example, those that can demonstrate trust with their regulators will be more effective in attracting strong fintech partners that understand the importance of regulatory cooperation. In this way, leveraging trust can mitigate risk and enable a bank to benefit from those fintechs that demonstrate sustainability, turning them potentially from competitors to partners.

Overall, intense competition is likely to remain a prevailing force in financial services — whether it’s coming from fintech providers or other traditional banks, customers are spoiled for choice. But thinking about how you can differentiate, especially in the context of an evolving market, is the mark of a great innovator. And, critically, that differentiation doesn’t always have to come from the future, sometimes, it can come from history. Sometimes, it can be as simple as doubling down on your own reputation.