What Is the Future of Buy Now, Pay Later?

April 13, 2023

By: Kate Drew

Buy Now, Pay Later and Banking

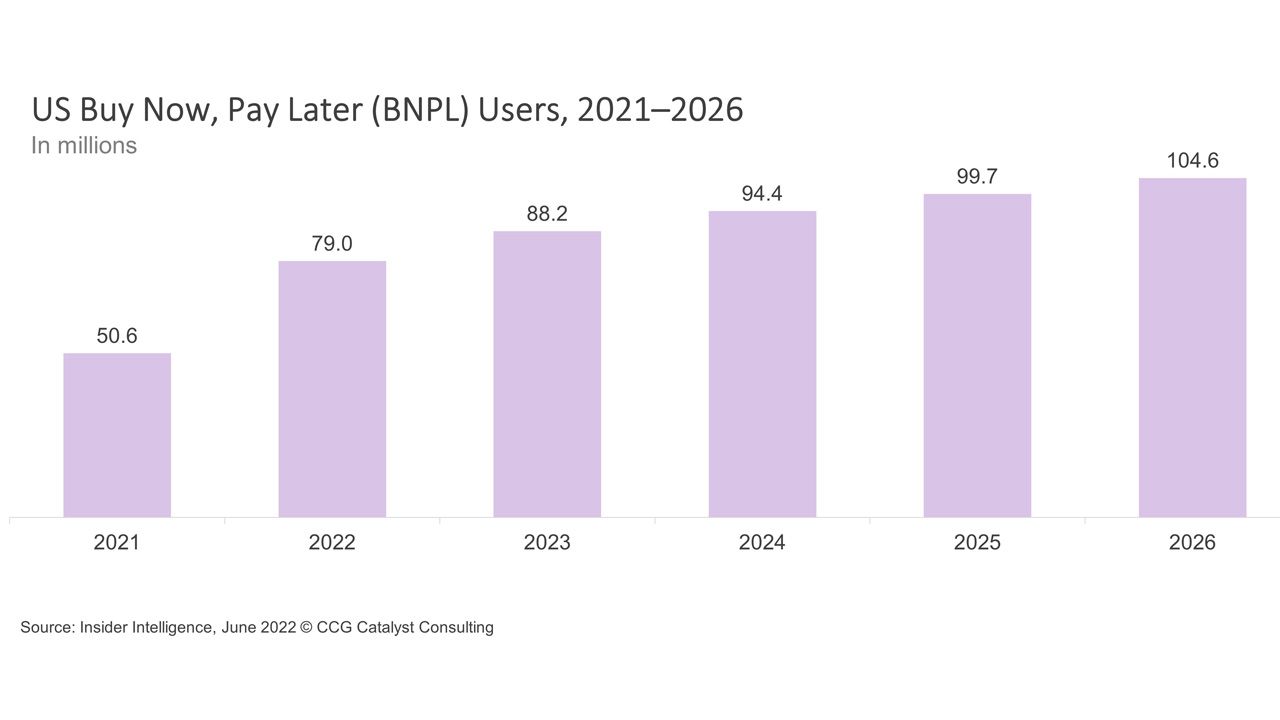

Buy now, pay later (BNPL) is a novel lending scheme that grew tremendously during the pandemic, leading fintech providers specializing in such services to become household names — think Klarna, Affirm, Afterpay. And it’s continued to cement itself as a payment option, becoming an almost expected function at the point of sale. Even Apple is getting in the game, with its recently announced Apple Pay Later product. And, according to data from Insider Intelligence, US BNPL users are expected to top 100 million in the next three years. That’s nearly a third of the population!

BNPL is talked about a lot these days, and it’s clear why. But what’s talked about less is how this area applies to banks. Traditional BNPL providers represent a threat to banks largely because they can siphon sales that might normally go through a bank, especially through bank-issued credit cards. In fact, according to McKinsey’s Consumer Lending Pools data cited by the Federal Reserve Bank of Kansas City, banks lost $8 billion-$10 billion in revenue per year over the past couple of years to fintechs offering BNPL products. However, the response from banks (excluding the largest institutions) has been pretty muted, likely due in part to regulatory scrutiny surrounding the space.

Such hesitation is understandable, but it is likely misplaced, for a couple of reasons. First, as Credit Union Times points out, many laws that might be applicable to BNPL, such as the Truth in Lending Act and the Fair Credit Billing Act, are already followed by traditional financial institutions. That makes these organizations very well positioned to get into BNPL in a safe and responsible way. And second, banks have a wealth of data that would make them extremely well placed to offer installment loans to their customers, data that fintechs without existing relationships simply do not have. This is an important point, because it means that traditional institutions could really compete in this market by improving the customer experience beyond what fintechs can offer — which is something they often struggle to do.

Overall, based on Insider Intelligence’s data, BNPL is here to stay. In fact, the ability to pay for purchases, especially large purchases, in chunks over time is seemingly embedding itself into the psyche of the US consumer. So this is really about how to respond to that reality. You can bury your head in the sand, or you can look at this as an opportunity to create a new value proposition for customers. While launching BNPL will take work, the barriers to entry are starting to lower with the introduction of installment products from key players like Mastercard and Visa that can help institutions get to market faster. Given all of this, considering what your strategy might be in future where BNPL is ubiquitous is likely a worthwhile exercise.