Fintech App Downloads Don’t Equal Engagement

November 10, 2021

By: Kate Drew

Fintech Apps Downloaded vs. Usage

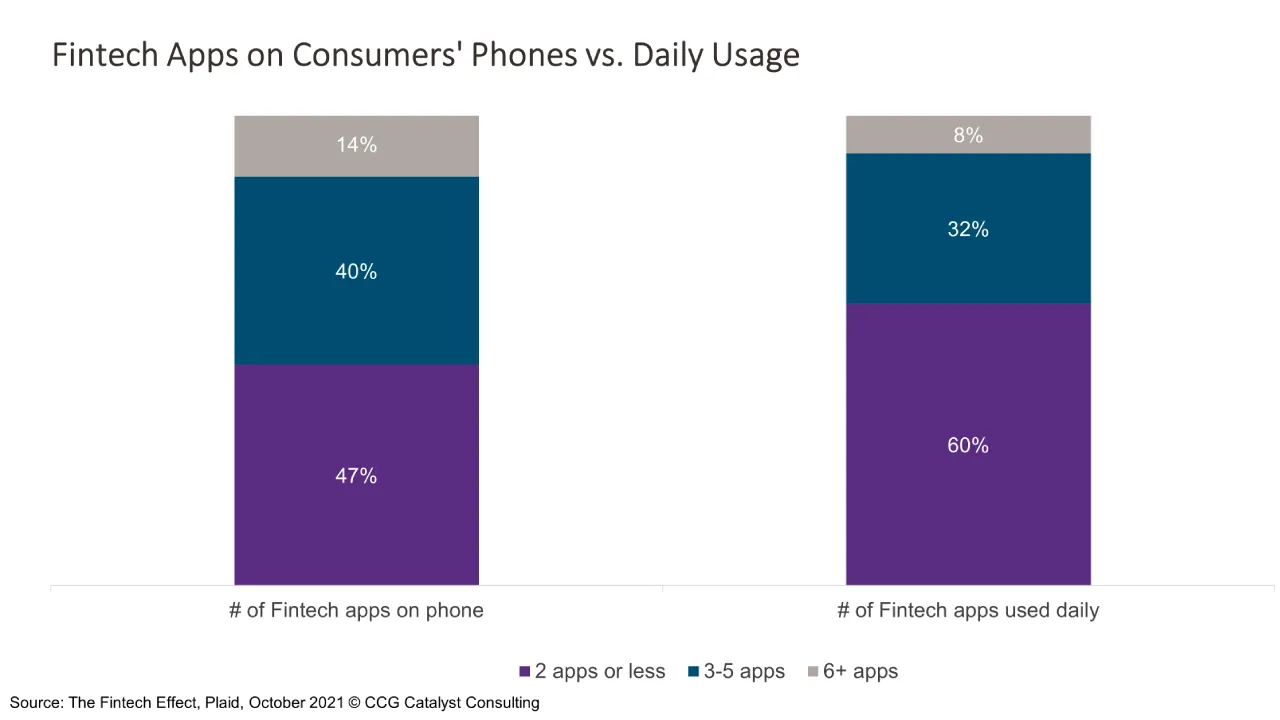

Fintech app downloads don’t equal engagement. We’ve long known that the fintech industry’s tendency to measure success in users or downloads is a bit flawed, because it doesn’t speak to activity. And now, new data from Plaid’s The Fintech Effect sheds some real light on the gap here. Specifically, while in the past year or so fintech app downloads have skyrocketed, with 54% of respondents to Plaid’s survey claiming to have three or more fintech apps on their phone, 60% are using only two apps or fewer daily. This reinforces a commonly held assumption that many users will download apps but fail to actively engage with them, creating not only less-than-profitable relationships but also cost centers for the business on the other side.

For the banking industry, this might feel like a win. It shouldn’t. The study defines fintech as “any digital service that a consumer engages with in order to manage their money, including online banking, payments, investing, savings, budgeting, borrowing, and goal-setting.” That means banking apps are included in the mix here, and there is no assurance that they rank favorably on the list for user engagement. In fact, this data should be worrying to traditional financial institutions (FIs), because it means that customers are downloading more options but using just a few, and therefore, these FIs are competing head-to-head with tech-savvy fintech startups for precious screen time.

The major issue for traditional institutions here is that fintech startups are designed for engagement. They have a fierce commitment to user research, conducting A/B testing on even the most granular of choices. As such, it’s likely that, while not every one of them is going to come out on top, (creating serious competition within their own ranks), they aren’t likely to have too much trouble pulling users away from the run-of-the-mill mobile banking app, either. That’s why differentiation is key.

As we discussed last week, these providers are putting the customer back at the heart of the value proposition and pushing banks to do the same, especially as the correlation between engagement and satisfaction is growing clear. Over time, bank execs are going to have to get comfortable with the idea that a well-designed user experience is an important ingredient to success. It’s hard to stress this enough — the notion that retail banking has become commoditized is not an excuse. Things are changing. The question is, are we going to come out swinging or not?