Consumers Look for Openness

February 9, 2022

By: Kate Drew

Consumers and Bank Partnerships

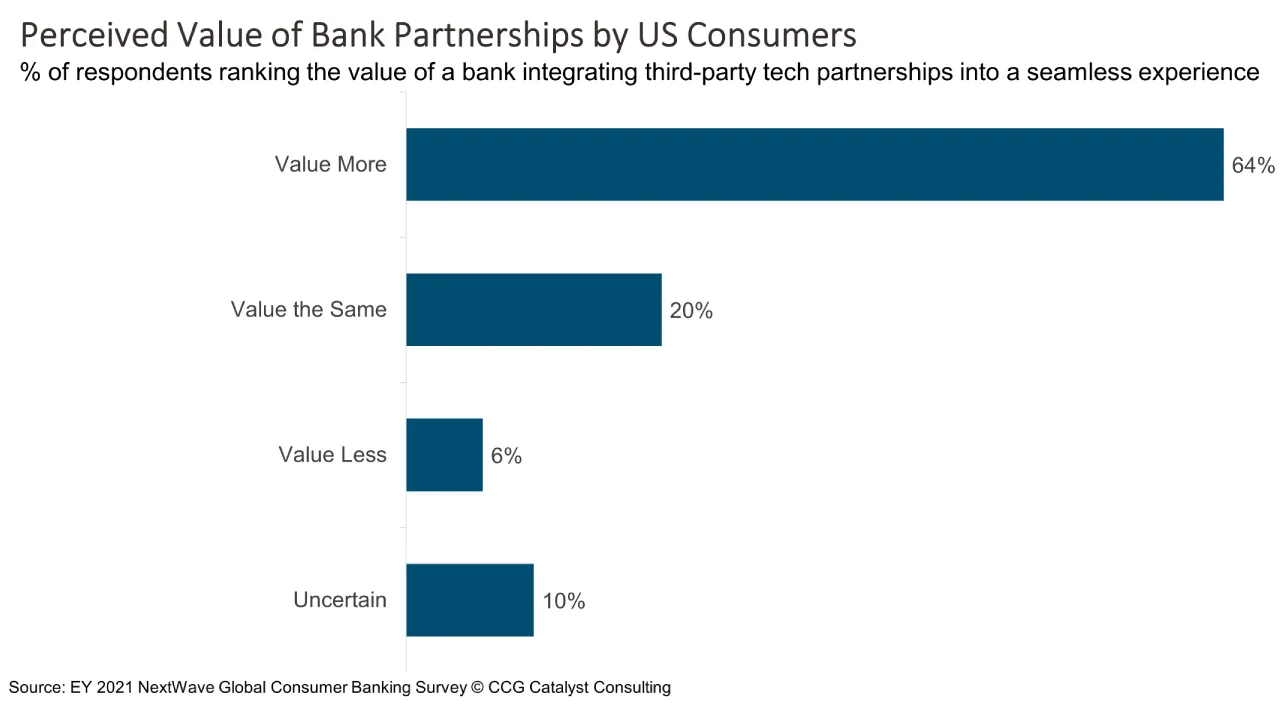

While US consumers may not be entirely clear on what open banking is, they seem to agree with its underlying principles — namely, the idea that financial institutions (FIs) should embrace data-sharing and third-party collaboration. In fact, according to Ernst and Young’s 2021 NextWave Global Consumer Banking Survey, 64% of respondents said that a bank integrating third-party technology partnerships would bring more value in creating a seamless experience. Now, it’s important to make a distinction here between bank partnerships widely and open banking — the former is a broad category, whereas the latter (at least, traditionally) refers to the ability to share data with third parties. However, the belief among consumers that banks should be embracing collaboration generally is promising, for open banking in the typical sense as well as for related initiatives that rely on ease of integration.

This data signals that FIs need to be thinking about how they can build their strategy and culture to support a future where openness broadly is key. Beyond data-sharing, this can refer to interoperability with third parties to enable new and richer experiences for customers. Think, the ability to see your bank balance from one institution in another institution’s app, or the ability to use a peer-to-peer (P2P) payments service like Venmo from within your FI’s portal. As we’ve discussed before, the real trend here is toward infrastructure flexibility. It’s about getting your systems to a point where they can support any kind of integration you may want today, or tomorrow, all aligned to the bank’s overall long-term strategy. That can be done either by working with your core provider, though many of these firms tend to be at the beginning of their own open banking journeys, or by creating a dedicated application programming interface (API) layer that can easily deliver data and functionality to the outside world. Either way, it means taking closer look at your infrastructure and making sure you’re positioned to succeed in a future that doesn’t yet exist.

It’s one thing to think about opening up your systems as a result of potential regulation — it’s quite another to be thinking about it as a way to gain a competitive advantage. The most forward-thinking institutions have been working to introduce flexibility to their technology stacks for quite some time, not because they think one day they will have to, but because they believe compiling the best of what the market has to offer through collaboration will win business. If this latest survey data is correct, they’ve made a very good bet. But, more importantly, it’s not too late to join this party.