Half of US Consumers Have Heard of Open Banking

October 13, 2021

By: Kate Drew

What Is Open Banking?

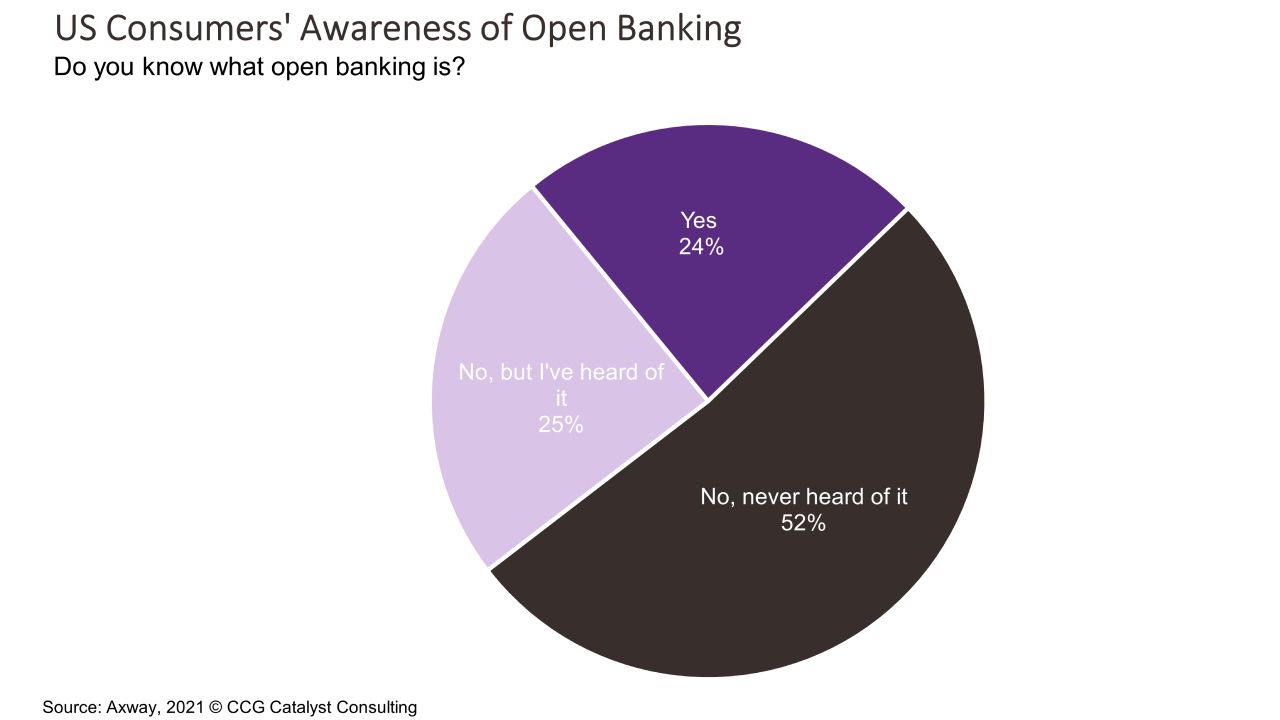

Open banking is hitting the mainstream not only with financial institutions — but also with consumers. In fact, nearly half of US consumers have heard of open banking, according to new survey data from Axway. While only about a quarter of these folks know what open banking is, that so many are at least aware of the concept should be enough to get even the most traditional of institutions standing at attention.

Based on this data, we are now at a point where open banking is a familiar term in the US with the three major groups that will drive its adoption: regulators, banking providers, and customers. And customers are perhaps the most important piece of the puzzle. That’s because traditional open banking regulation, which the Biden Administration is currently exploring, is based on the idea that customers own their data. As a result, consent is a central tenet of open banking regimes around the world. Getting customers familiar with the idea, and eventually onboard, will be key to the success of open banking in the US, regardless of how our government and institutions approach it.

The next step is going to be education — and this is a massive opportunity. Most consumers in the US still don’t know what open banking is exactly, and defining it for them in a way that makes sense and mollifies concerns is going to be critical to its use. According to the survey, when the concept was explained to them, half of respondents didn’t feel it was positive and worried about issues like losing control over access to their financial data (47%) and ongoing monitoring of their financial activity (33%). This suggests there is quite a bit of work to do when it comes how we create context and understanding around open banking and ensure consumers feel comfortable and secure. Promisingly, consumers do seem to agree with the key premise that they should own their data, with 84% of respondents saying as much.

As open banking truly gets underway in the US, there will need to be a real focus on communication and outreach to help customers into the fold. And that responsibility is likely to fall on the shoulders of their primary financial institution — that’s right, their bank. Preparing early for this moment is smart, as it provides banks with the ability to control the narrative in a way that not only encourages adoption, but also gives them the opportunity to highlight where they sit and how they can help. For example, a bank that positions itself as on the side of the customer, ready to help them take control of their data and financial life, is likely to win loyalty in the process.

Open banking is making a slow (very slow) march into the US. There’s no question about that, but it does seem to be coming. And with consumers now at least somewhat familiar with the concept, it’s time to start thinking about how we talk with them about it. Getting an edge here is low-hanging fruit that should not be overlooked.