Digital Account Opening, Data Analytics Are Top Technologies for 2023

February 16, 2023

By: Kate Drew

Banks and Technology Priorities

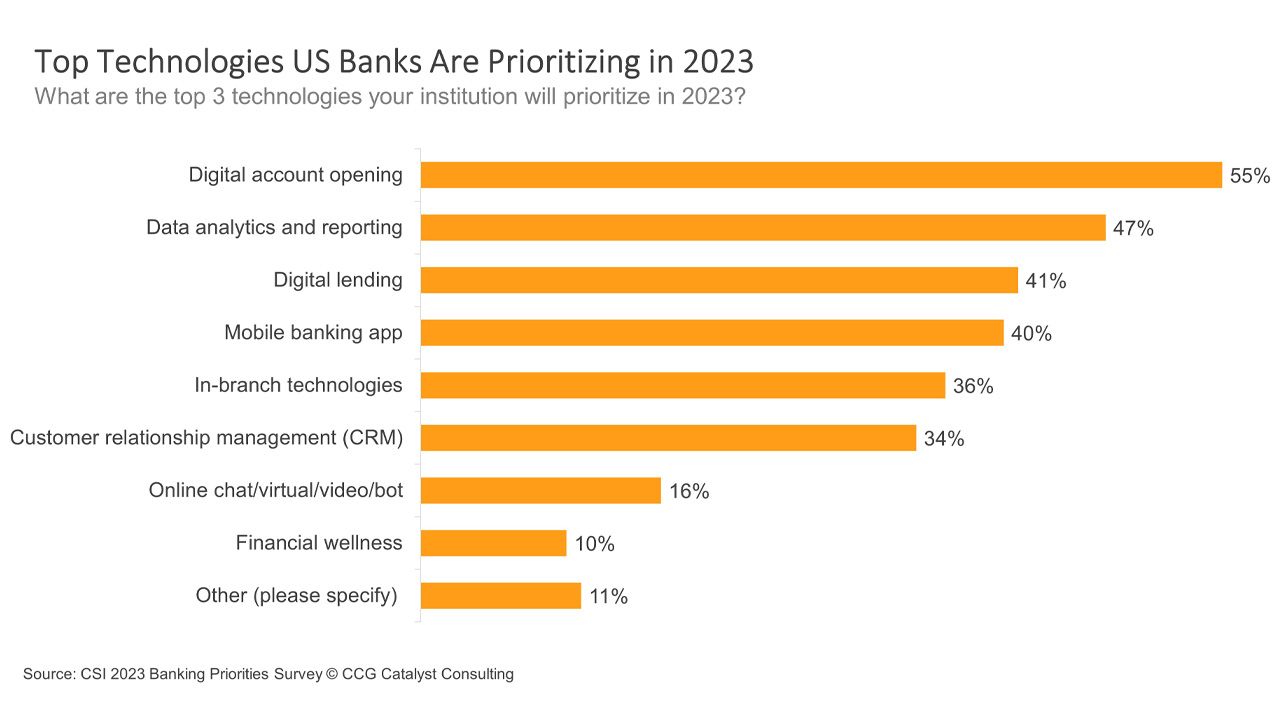

A couple of weeks ago, we took a look at bank executives’ plans for technology spending in the year ahead — the main takeaway of which was that a majority expect to increase their investment in 2023, despite an uncertain economic backdrop. Now, we’re zeroing in a bit more on exactly where they plan to spend that money. According to CSI’s 2023 Banking Priorities Survey, the top two areas bank executives are prioritizing from a technology standpoint this year are digital account opening and, in keeping with the Arizent data explored in our prior post, data analytics and reporting.

Digital account opening is no surprise — it’s snagged the top spot for the last couple of years in CSI’s annual study. Data analytics and reporting, on the other hand, has grown in importance. In fact, it moved up three notches on the list this year from position five in 2022. Meanwhile, customer relationship management (CRM) dropped from the second place spot last year to the bottom half of the list. These changeups may seem impactful, but they actually point to the same trend we’ve been discussing for a long time — the need to achieve a full picture of bank customers and their habits in order to better deliver products and services. A good data strategy underpins digital account opening and CRM, and banks seem to be getting better handle on the connection there.

If you remember back to our coverage of last year’s report, our focus was on the 360-degree view of the customer. That hasn’t changed with this new data. If anything, it only strengthens the idea that, the better you know your customers, the better you can serve their needs, and data is at the heart of that. There is a reason that data and analytics is increasingly landing at or near the top of banks’ priority lists. It’s because executives are better understanding how valuable data can be if you can leverage it effectively.

Unfortunately, that last part — leveraging it effectively — remains the thorniest, as it speaks to the integration piece of an overall data capability. If data is siloed, it’s not very useful. As such, as we’ve often discussed, banks need to make sure all the necessary systems are talking to one another in order to collate data across customer interactions in a meaningful way. Getting there will require providers to bring on talent capable of defining and executing on a clear roadmap as well as thinking through their overall infrastructure, how it fits together, and most importantly, how it works together.