The 360-Degree Customer View

April 7, 2022

Banking and Customer Lifecycle

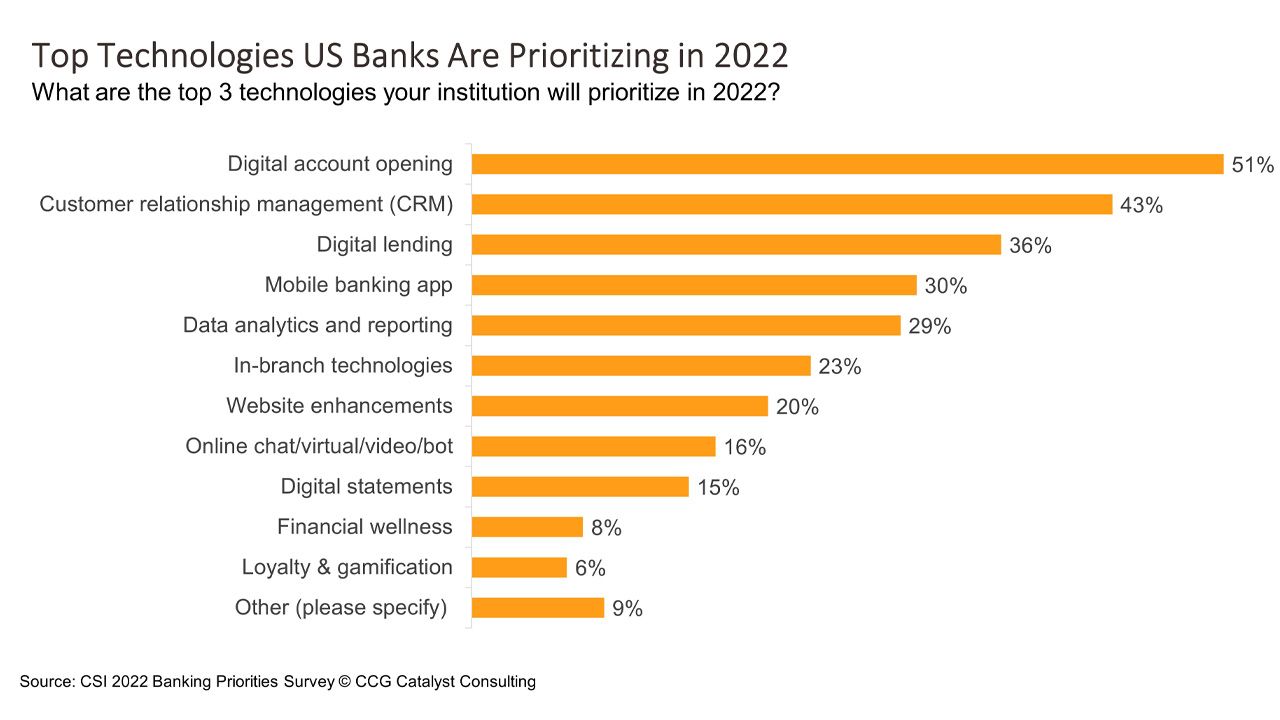

Banking providers today are getting serious about the customer funnel. In fact, according to CSI’s 2022 Banking Priorities Survey, the top two priorities for US banks for the current year are digital account opening and customer relationship management (CRM). This makes a lot of sense, as winning and retaining customers has become increasingly difficult for many in the current environment, which is highly competitive and flooded with tech-savvy digital challengers. Fintech neobanks, in particular, pride themselves on being able to open accounts in just a couple of minutes with only a few clicks. What’s interesting about the data, though, is that it’s not just the top of the funnel that’s in focus for these banks, it’s the relationship-building aspect, too. The question then is, are banks thinking about these priorities together? Digital account opening and CRM are inextricably linked — or, at least, they should be.

Getting a customer onboarded seamlessly is one thing, but capturing who they are and continuing to build on that is where you will start to generate real value. Digital account opening providers know this, and they are starting to bill themselves as more than just springboards for new business. Rather, they are positioning their products as sales management platforms, designed to drive leads and capture information that can drive more opportunities. NCR Terafina’s needs analysis tool, for example, can help identify cross-selling opportunities within the account opening process and dynamically recommend products to applicants. That allows a bank to go beyond account opening at its very first interaction with a customer. The point here is that, when looking at these solutions, we need to think a little bit bigger — your digital account opening tool should be doing more work than just opening accounts; it should be gathering information, using it intelligently, and be fully integrated with your CRM capability.

Taking this conversation even one step further, though, it’s really about data. The better you know your customers, the better you can serve their needs. And every single interaction you have with them, every single click, is a data point. Sometimes, we refer to this as the “360-degree view” of the customer. It starts with account opening and pulls all the way through the customer lifecycle. To accomplish this, we need to start thinking about all of these interactions together and make sure all the necessary systems are talking to one another. If you’re compiling different solutions at different customer touchpoints without a data strategy underneath, you’re not taking advantage of all those data points coming into the bank. Instead, we’ve got to start thinking about data in a holistic way. Digital account opening and CRM are just one example. The real goal is to develop a data strategy that centralizes all of the information you have on your customers in one place and makes it actionable. So, maybe start thinking about how you are approaching the customer view overall. How are you building it? And how are you using it? That’s likely where the ultimate competitive advantage lies.