Digital-Only Providers Make Customers Happier

May 19, 2022

Digital Banking and Satisfaction

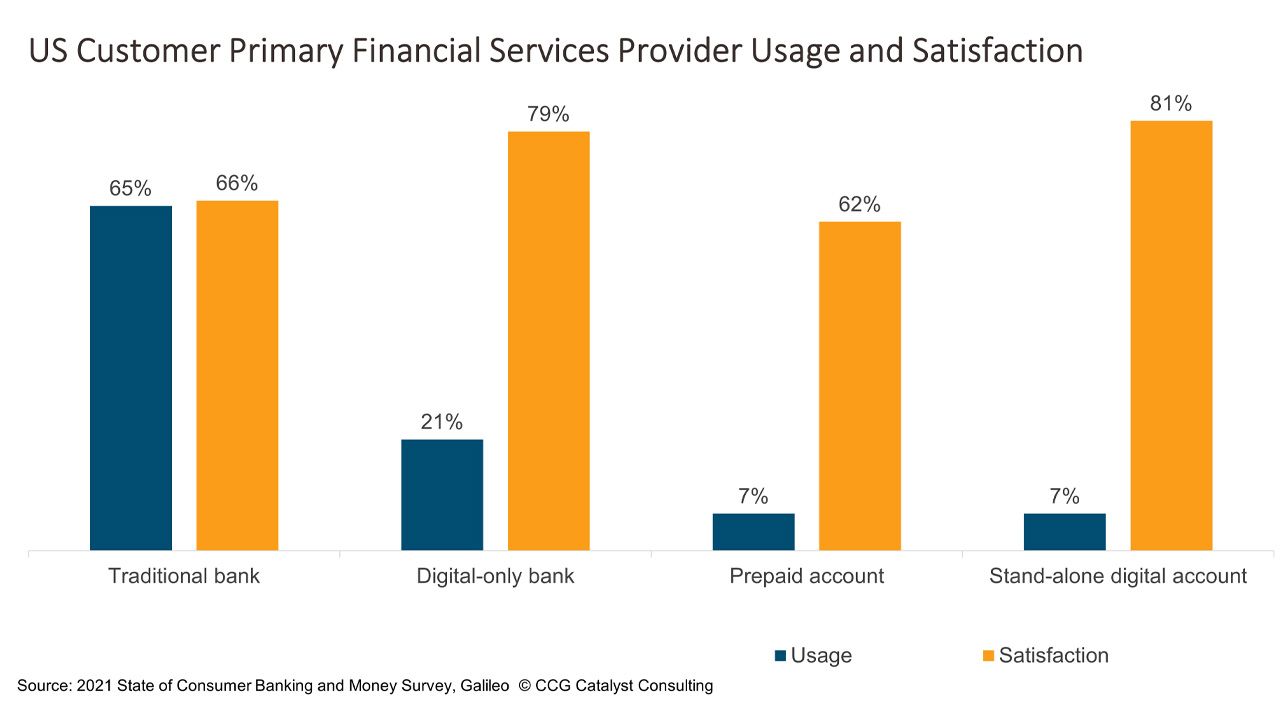

Most US consumers still use a traditional banking institution as their primary financial provider, but they are less satisfied than those who do not, according to Galileo’s 2021 State of Consumer Banking and Money Survey. Specifically, while 65% of respondents to the survey reported using a traditional bank (defined as a bank or credit union with at least one physical location) as their primary provider, just 66% said they were satisfied; that compares with satisfaction levels of 79% and 81%, respectively, for those who use a digital-only bank (e.g. Varo Bank) or a stand-alone digital account (e.g. Venmo) as their primary account, despite many fewer customers saying they do so.

This data should be worrisome to traditional providers because it reinforces the idea that newer, digital-only players are outdoing them on experience in a way that matters to consumers, and they’ve likely only been able to hold on to their central role as the industry’s default primary providers due to a lack of awareness or laziness. The problem is those barriers aren’t likely to hold over the long term — in fact, they may already be eroding: The survey also found that a majority of consumers (62%) would be highly or somewhat likely to switch to a digital-only bank at some point in the future. And perhaps even more concerning, up-and-coming generations like millennials and Gen Z, which are growing in importance as they age and build wealth, expressed an even greater inclination to switch at 77% and 72%, respectively.

If you’re a bank looking to stave off these threats, the first step is to think about your own customers. As we’ve stressed before, digital-only players are good at creating satisfying experiences because they get very close to their customers and work hard to understand their needs. While many banks in the US, especially community institutions, are known for this kind of relationship-building in the physical world, digital-only providers are able to apply it to where most customers are today — their phones. They also formalize the way they get to know their customers and their needs through comprehensive and iterative user research programs. In order for traditional banks to compete, they need to start thinking about how to adopt some of these practices. When was the last time you ran a survey, for example? What about a focus group?

These tactics are key to developing products and services that will resonate because they give you data with which to drive development. Once you have those insights, you’re no longer driving in the dark. Essentially, your customers can build the roadmap for you, and then all you have to do is follow it.