Next-Gen Tech Can Lower Costs Up to 70%

March 30, 2023

By: Kate Drew

Next-Gen Core Banking

While liquidity and risk management are taking the spotlight right now (understandably), it’s important to remember that certain other imperatives aren’t going anywhere, and it will be necessary to keep those balls in the air as we all move forward. Of course, as you might have guessed, this is largely about technology transformation efforts. Specifically, the need to update core infrastructure, a feat many (if not most) banks are dealing with today, is still a major stumbling block for traditional institutions looking to move into the future. And developing a forward-looking infrastructure strategy is going to remain a central obligation for banks broadly.

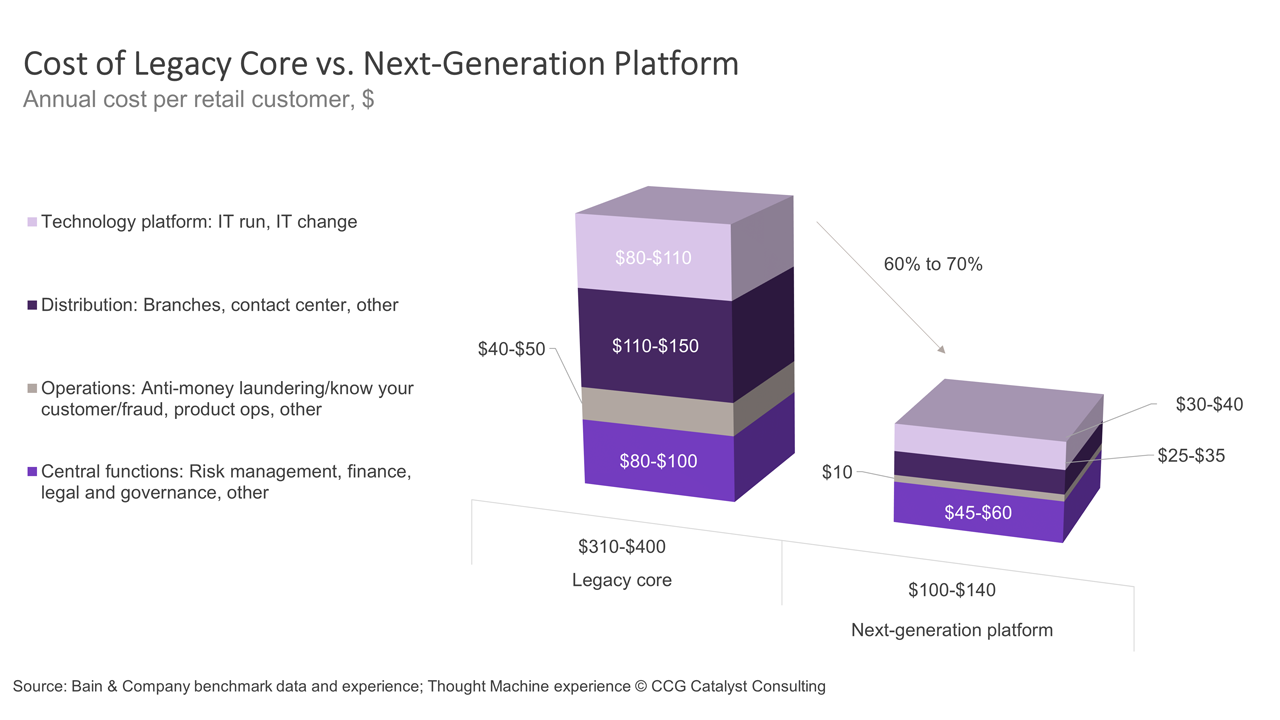

In defining what such a strategy might look like, the first thing you need to understand is the options. While it is certainly possible to move to an updated version of an established core system, the benefits of next-generation platforms are growing more and more clear. In fact, according to a recent analysis by Bain & Company, based on its own data and experience as well as input from Thought Machine, the cost base for an institution operating a modern banking platform can be 60-70% lower than for a mid-tier legacy bank on traditional technology. This, combined with data that shows next-gen core banking systems can dramatically increase speed to market over traditional legacy systems, suggests that moving to such technology should really be a no-brainer.

But — what about the risk involved? That’s always going to be the question. These systems are new, built on the latest technology, and thus, largely unproven. And that can make a lot of executives nervous. So, how do you get comfortable with this technology to eventually reap the benefits? As the analysis points out, one way banks are doing this is by creating standalone brands built on next-generation systems that can serve as a proving ground. Oklahoma-based Citizens Bank of Edmond’s upcoming military-focused digital bank is one example of this as are NatWest’s Mettle and Bank Leumi’s Pepper in Israel. Additionally, a bank may choose a similar strategy in which it migrates parts of its business over to a new platform in a phased approach, as Tulsa’s Vast Bank is doing with SAP. This tack allows a bank to vet a new system (with the intention of using it for its existing business) before moving all of its operations over. (We explore such examples and their approaches in our recent report, Successes in Transformation: Lessons From the Field.)

The overall point is that moving to new technology doesn’t have to be scary — and it doesn’t have to happen all at once. In fact, it seems as though the prevailing strategies for how to embrace the benefits of new platforms without taking on undue risk all have one thing in common: patience. Ultimately, an infrastructure upgrade doesn’t have to be about getting it done and over with, and it definitely shouldn’t be about checking some future-proofing box. Instead, putting the typical core conversion option on the backburner in favor of taking your time and slowly moving into the future may be the way to go. In fact, in the end, it might actually help you to get there faster. One thing is for sure, though, the status quo isn’t going to cut it anymore. And, as such, institutions need to be thinking about what their future is built on. Hopefully, for the reasons we’ve laid out here, they will be doing so with an open mind and a long-term view.