Gig Economy Workers Flock to Mobile Payments

October 20, 2022

By: Kate Drew

Gig Economy and Mobile Payments

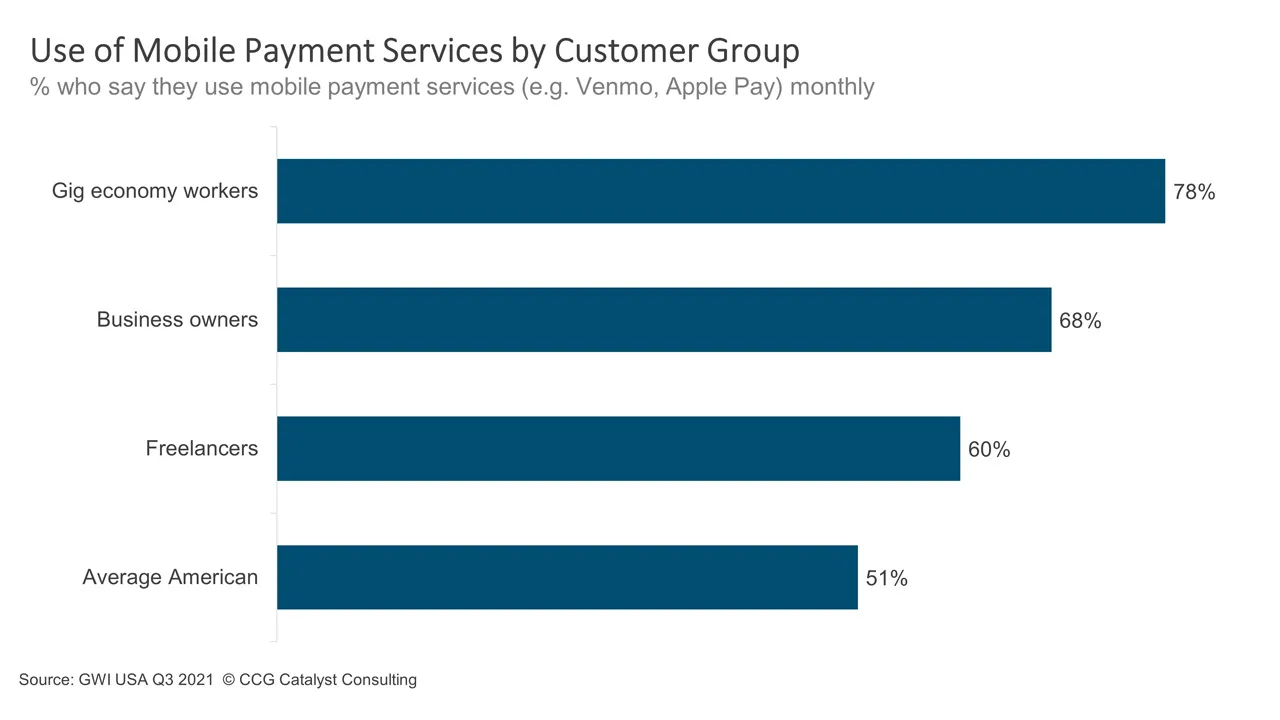

Mobile payment apps like Venmo and Apple Pay are growing particularly popular with gig economy workers, according to data from GWI USA. In fact, gig economy workers are around 30% more likely to use such services than the average American — per the report, 78% of gig economy workers said they use mobile payment apps monthly, compared with 51% of US consumers broadly.

While it may not seem like it outright, this poses a threat to traditional banking providers. That’s because, as gig economy workers embrace these apps, it’s becoming easier and easier to use them for their regular banking needs. Venmo provides a debit card, for example, and allows users to store money within the app. As such, gig economy workers using mobile payment services don’t necessarily need a typical bank at all. Meanwhile, according to the report, 40% of this demographic doesn’t have a credit card or a savings account, meaning there is considerable opportunity to cross-sell to these users if you’ve got a primary banking relationship with them.

So, why does this group matter? Well, according to Statista, the gig economy is expected to be worth $455.2 billion in 2023. That represents a massive amount of capital up for grabs that traditional institutions may struggle to tap into. (Note: Statista defines the gig economy as digital platforms that allow freelancers to connect with potential clients for short-term jobs, contracted work, or asset-sharing, while GWI breaks out freelancers separately.) Moreover, in a post-Covid world, many are still welcoming remote work and leaning hard into contract gigs that offer flexibility, in some cases, even if they also have full-time roles. As a result, there is likely going to be a continued shift toward this market, making it even more lucrative in the future.

Those interested in tapping into this area should be thinking about what kinds of tools such workers might require that could make a traditional bank account attractive — perhaps tax support or analytics that can help project cash flow, for instance. Of course, not everyone is looking to go after the gig economy per se. But this group does represent a large opportunity as well as a “new” type of community that the country’s institutions could benefit from serving if they can correctly identify and satisfy their unique needs. And, because of the way the workforce is changing, many more people may end up falling into this bucket than you might expect, meaning other core demographics could be at risk of attrition if the gig economy goes unattended.