Improving Customer Experience Is #1 Data Priority for Banks

July 13, 2023

By: Kate Drew

Banks and Data

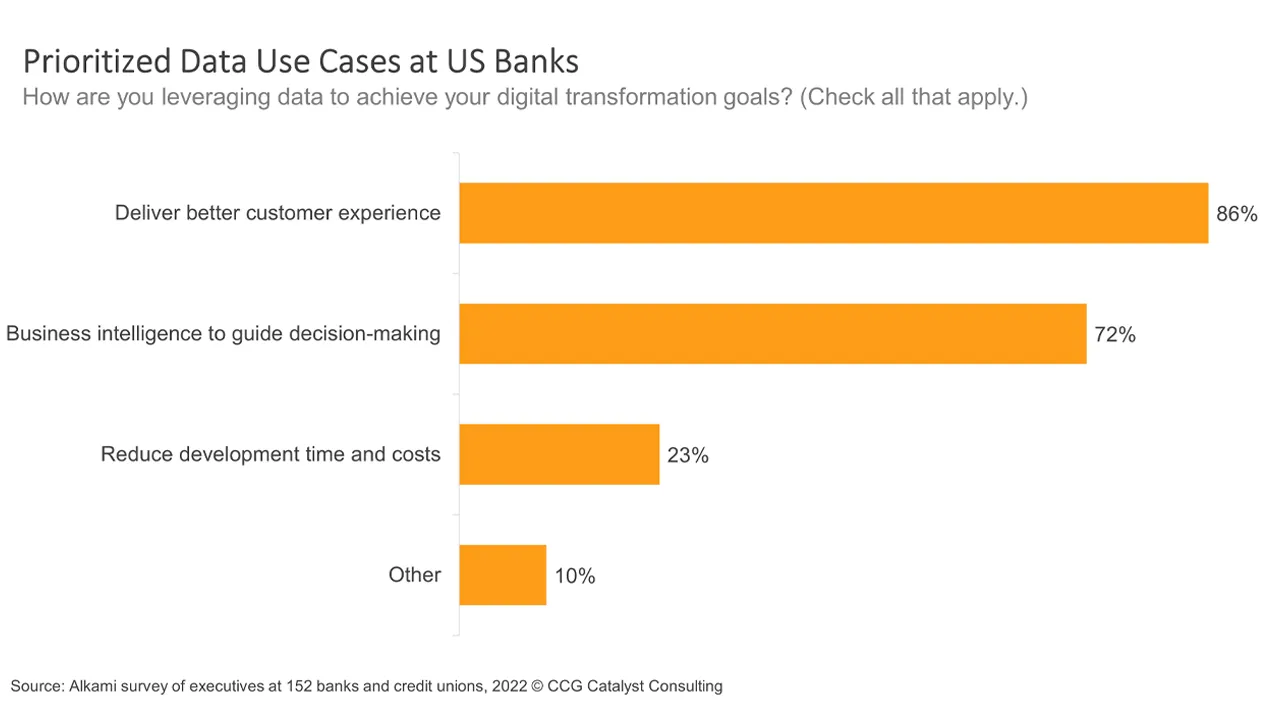

Data is obviously a key part of the discussion when it comes to innovation, especially in the context of the customer experience. And a recent survey from Alkami puts some hard data (no pun intended) behind that connection. Specifically, in a survey of executives across 152 banks and credit unions, 86% said that they are leveraging data to deliver a better customer experience as part of their digital transformation goals, making it the top choice selected.

As we’ve talked about recently, data capabilities are top of mind for bank executives, particularly in light of the flurry of artificial intelligence (AI)-related activity hitting the market in the wake of the launch of ChatGPT late last year. And there are many, many ways data analytics (whether AI powered or not) can be used inside of financial institutions, both to drive internal efficiencies and externally. What makes it such a good fit for the customer experience conversation, though, is its promise to create the kind of personalization in banking that we’ve all become so accustomed to in other areas — think of the recommendations provided by Amazon or Netflix, for example. In financial services, we have not yet fully cracked things like personalized delivery of offers or highly tailored yet automated financial advice. Data is the fuel that will get us there, and it’s a positive sign that executives seem to realize this.

The big elephant in the room, however, is the “how” of it all. There is a reason banking is behind other industries in delivering data-driven experiences. It’s not because the technology isn’t a good fit, or because industry leaders don’t see the value. They very clearly do. The problem is that effectively leveraging data in this way requires an integrated data infrastructure capability that can provide a 360-degree view of the customer, and that is incredibly hard to build for many banks, which are often still struggling with legacy technology debt. As a result, there are very few institutions that are in a position to make their data actionable today.

This is understandable, but it’s important to remember that hard shouldn’t be a barrier to success. It’s likely that interest in tapping data to power better customer journeys is stemming from a deep desire to be able to differentiate. And that desire is only going to grow more intense in this increasingly competitive environment. As such, it’s crucial that banks figure out how to set themselves up properly. Incorporating data initiatives into digital transformation is a good first step, but it’s not enough. Those that are serious about using data to power their customer experiences will need a well-defined data strategy that they can execute on. That’s the key — think about data as a key pillar of transformation, worthy of its own roadmap, rather than as a component. This is not a house you want to build quickly or without the proper foundations. In the end, those that get us closer to the ever-so-coveted Amazon-like experiences in banking will likely be those who understand the monumental nature of this undertaking, commit to the associated investment, and hire the right people to run with it.