More Choice Coming to Core Banking

June 2, 2021

By: Kate Drew

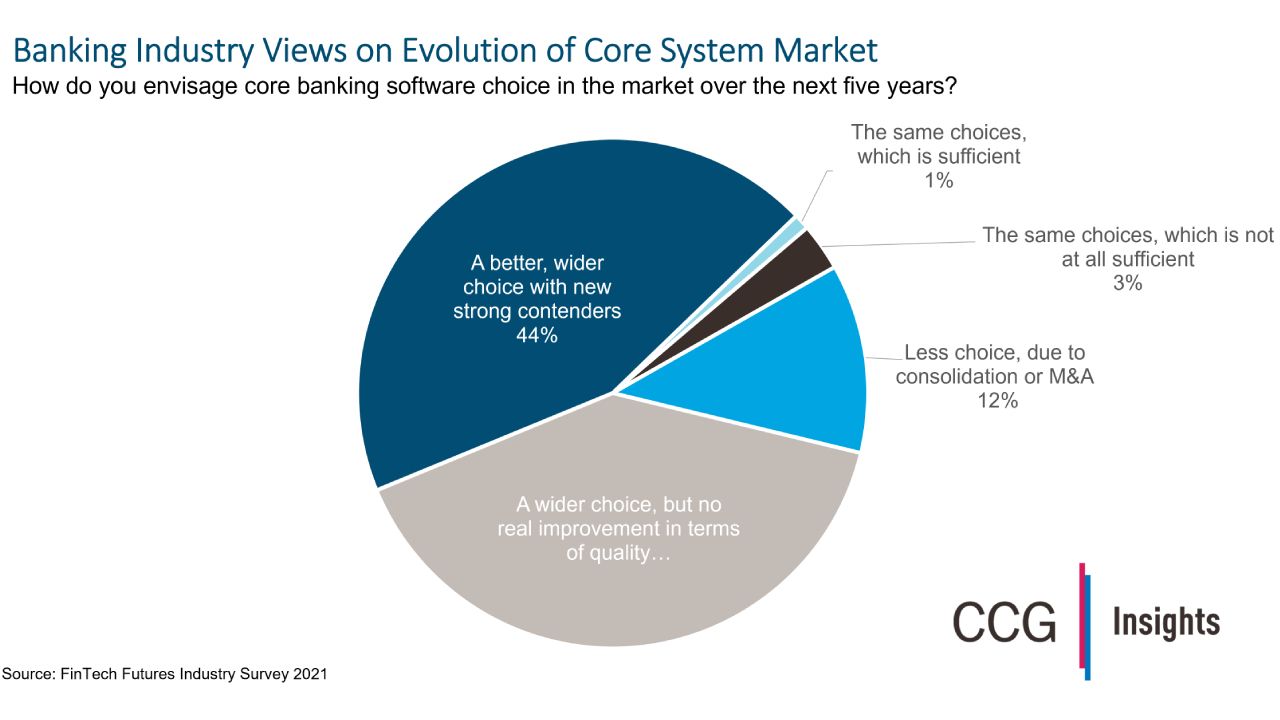

The banking industry believes more choice is coming to the core system market. According to a 2021 survey by FinTech Futures, 84% of respondents think that there will be more choices when it comes to core banking software in the next five years. Moreover, 44% believe there will be new strong contenders to choose from. This is likely to be a welcome development, especially in the US, where the majority of banks get their core software from just a handful of established vendors. And we may not have to wait that long; in fact, it appears as though we are already seeing the changes respondents are anticipating becoming reality.

In the last few years, we’ve seen a number of new entrants tackling the core banking space, including players like Finxact, Nymbus, and Neocova, to name a few. Additionally, core banking disruptors that have made a name for themselves in other markets are starting to come to the US — think Mambu, Technisys etc. What all of these players have in common, whether they are homegrown or coming from abroad, is a commitment to flexible, application programming interface (API)-first delivery. They also tend to be modular, making it easy for banks to implement their software without ripping out their existing core entirely, if they so choose. The emergence of these contenders suggests there is a need for some new blood in the market, and the interest they are seeing from banking institutions only confirms that hypothesis.

If the survey’s predictions prove true, we can expect to see even more choices coming to market in the next few years. As that happens, and the newer vendors today begin to establish their propositions with more clients, it’s possible that core banking will finally begin to resemble a competitive arena. Competition is extremely important in any market — without it, complacency sinks in and products and services fail to evolve at a productive pace. There are many areas of banking where fintechs have pushed the envelope and forced the industry to raise the bar. This is really just the next frontier, and it’s one badly in need of a good hard kick.