Raising the Bar on Personalization

July 28, 2021

By: Kate Drew

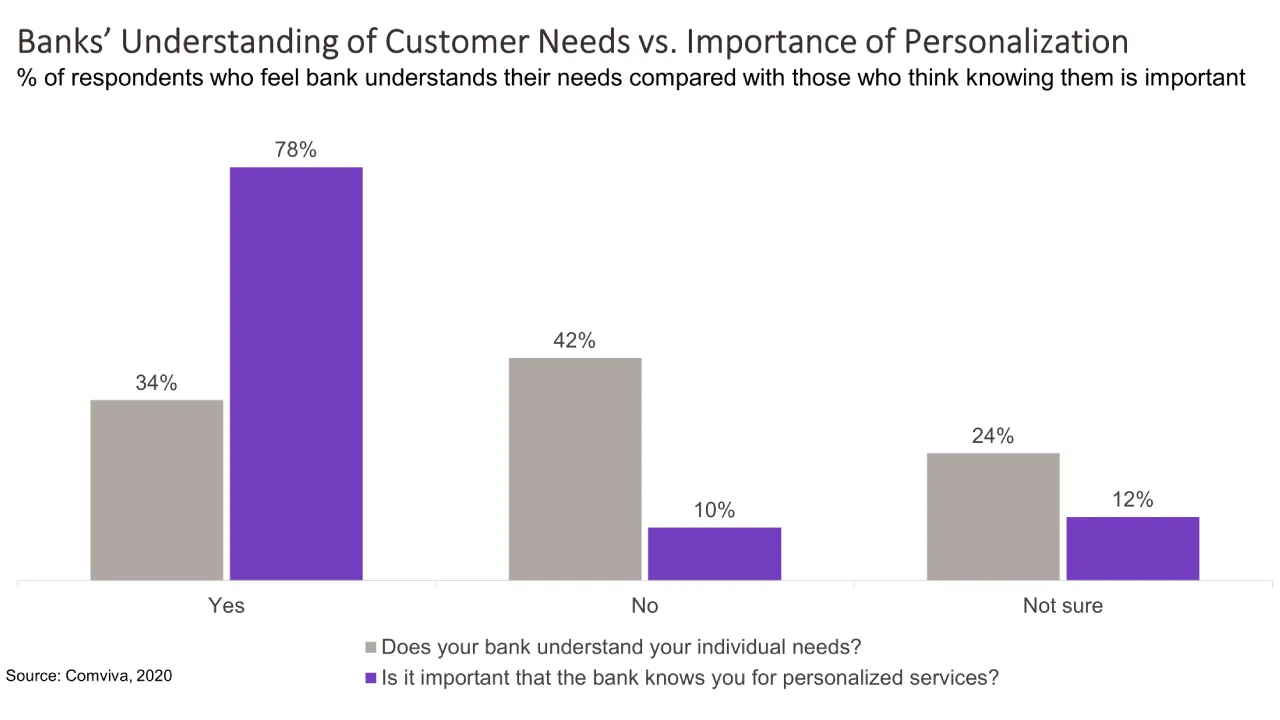

Banks today aren’t doing a good job understanding their customers’ individual needs, according to survey data from Comviva. The 2020 report, which polled consumers across continents, asked specifically whether or not respondents felt their bank understood their needs personally as well as whether or not they believe it’s important that their bank know them well in order to deliver personalization. While 78% of respondents agreed that it’s important for a bank to know them well, just 34% said they felt their bank understood their specific needs. This suggests there is a gap between what consumers are looking for and how well they think they’re being served.

Personalization in a digital world is a tricky animal because it involves not just knowing your customers well from a day-to-day standpoint — say, the way a community bank might — but also gathering the right data on them and ensuring it is actionable. This is the kind of firepower that enables a bank to begin to do personalization at scale. That might sound like an oxymoron, but it’s not. Well-built data infrastructure enables you to capture information about your customers on an ongoing basis — their likes, dislikes, where they shop, when they shop — and turn that information into actions. Often, this conversation slips quickly into personal financial management (PFM), or how to help customers better budget and plan based on trends in their spending. This is a worthwhile discussion, but once you’ve got your data in order, there are many more things you can do. For example, if my bank can see that I’ve been renting a car every other week for the last few months, it might show me what the economics of buying a car might look like and offer me an auto loan in the process. At that point, my bank is helping me to optimize my financial life with insights and options.

Consumers’ expectations for personalization are only going to continue to advance, especially as companies like Amazon are now generally further ahead of our needs than we are. It makes sense that people will be looking for that kind of guidance and support from their financial institutions, as well. Getting there, though, from a bank’s standpoint requires aggregating data from disparate systems and making it useful; that’s no easy task. Today, there are companies like MX and Plaid working to help banks overcome this challenge. These fintechs make data their job, and enlisting a partner may not be a bad idea, particularly for those that don’t have the development talent in-house. Regardless of how you approach this area, however, it’s important to remember to have a strategy first. A good data strategy is critical to organizing systems and resources around meaningful goals and outcomes for customers. Without this piece, you’ll only be throwing things at the wall.