Younger Generations Show Interest in Sustainability

February 17, 2022

By: Kate Drew

Bank Customers and Sustainability

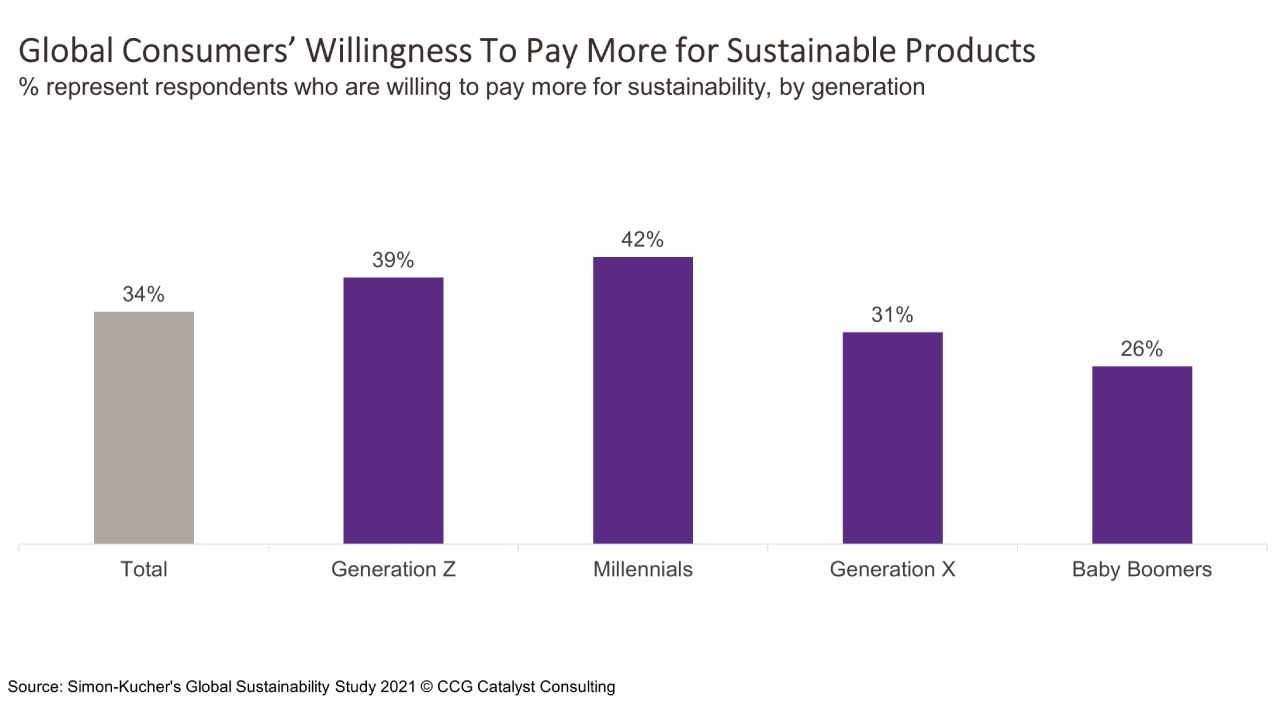

Interest in green banking — which refers broadly to engaging with financial institutions (FIs) and products that align with sustainability principles — is growing, especially among younger generations. And, not only that, but consumers are indicating a willingness to pay more for products that are sustainable or ethical. In fact, according to Simon-Kucher’s Global Sustainability Study 2021, more than a third of consumers surveyed globally said they would pay more for sustainable products across categories, with Generation Z and millennials showing particular inclination.

As customers begin to demand a greater focus on sustainability, we’re starting to see banking providers rise to the occasion in various ways. For example, neobank Aspiration is designed especially for users concerned about how their money is used — it helps users track their climate impact using transaction data, offers features like rounding up spare change that is invested in planting trees, and promises not to use funds in certain areas like fossil fuel projects. The company has amassed over 5 million users and will soon go public via special purpose acquisition company (SPAC). And more traditional organizations are getting in on the action, too: Portugal’s largest bank, Crédito Agrícola, partnered with personal financial management (PFM) specialist Meniga late last year to enable customers to track their carbon footprint through their spending. These kinds of offerings are aimed at satisfying users’ demand for green options, and in doing so, they are opening up a whole new category of products.

Banking institutions should be thinking about what this movement means for them. The demand is clearly there, but what does that mean for your product strategy? What specifically are your customers looking for? And what are they willing to pay for? The data from Simon-Kucher suggests that this isn’t simply an area where banks will have to offer new solutions for free (as has largely been the case with digital features, though there remains opportunity there, as well); rather, it’s an opportunity to create new products and services that can be sold to meet a need. While some features (like rounding up spare change to purchase trees) may not fall squarely into this category, others (like allowing users to track their carbon footprint) very well could. The trick going forward will be finding the right combination of services that drive value and stickiness while increasing revenue for the bank. This will only become more important as younger generations, those most sustainably minded, age and build wealth.

We’re still in early days here, but the evolution of this movement will certainly be an area to watch. It’s likely to be those institutions that start thinking about this now, in a thoughtful way, that will be best positioned to bring interesting propositions to market. This, of course, goes back to understanding your customers and their unique drivers. The first step is to find out what they think and what they want.