Consumers Tell Banks What To Prioritize

October 13, 2022

By: Kate Drew

Banking Initiatives and Prioritization

When it comes to new capabilities and features for customers, it can be difficult for banking providers to determine what to prioritize. There are so many options out there — online banking experience, mobile banking experience, budgeting tools, crypto, chatbots etc. So many choices! Too many choices! But what is it that customers actually want? According to a recent survey by Temenos, the answer is quite simple: ease.

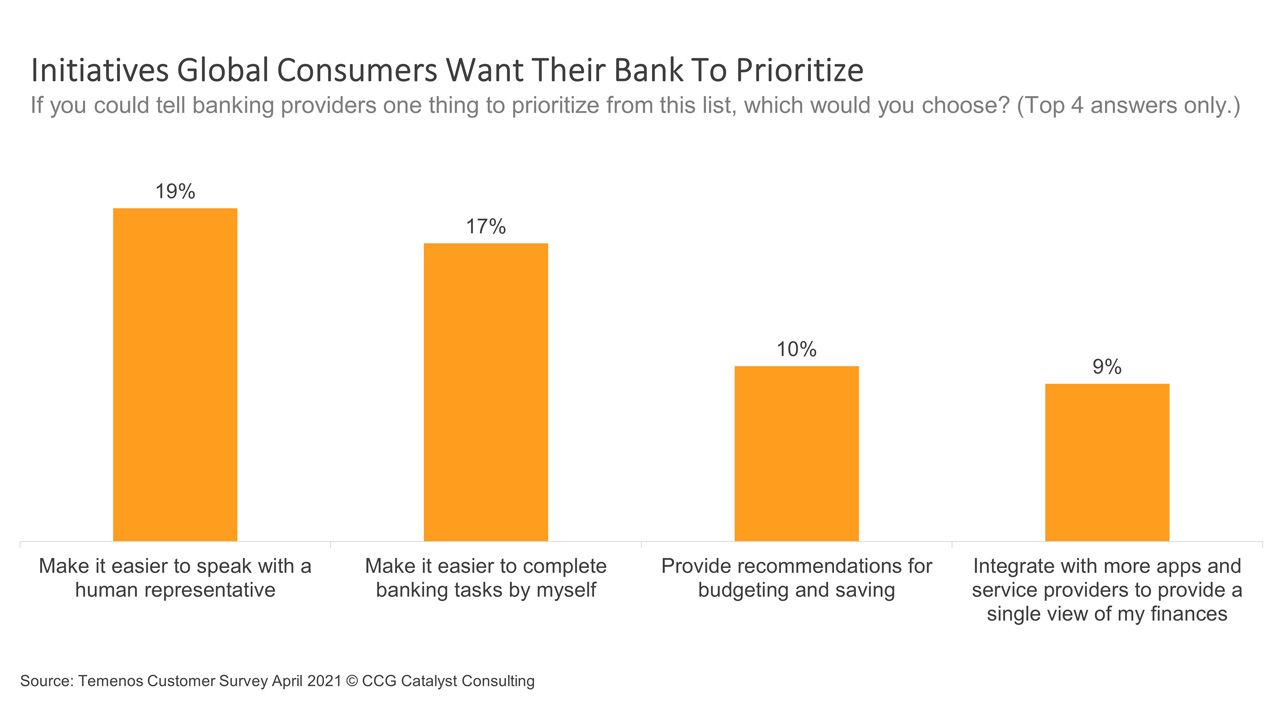

Specifically, when respondents were asked which single thing from a list they’d like their bank to prioritize, the top two choices were make it easier to speak with a human representative, selected by 19%, and make it easier to complete banking tasks by myself, chosen by 17%. At the end of the day, consumers don’t seem to care very much about specific solutions; they may not even really know what it is exactly they need, at least, not consciously. What they do want, however, is for banking to be easy. No one wants to spend a ton of time completing tasks related to their financial life. They just want it to work. And people today are being conditioned to expect elevated levels of ease by other experiences in their lives — like those provided by Amazon, Uber, or Netflix. As a result, their banks need to be thinking about how they can deliver similar experiences, seamlessly. They need to be thinking about how to simplify.

Interestingly, neither of the items at the top of the list in Temenos’ survey speak to technology specifically, but they do speak to things that technology can facilitate. Often, we think about the promise of technology as the ability to add bells and whistles. But, when used thoughtfully, it can actually be a really powerful tool in simplifying things. Technology can be used to smooth processes and handle complex tasks, creating a more streamlined experience for the customer on the frontend. This kind of innovation isn’t quite as exciting as the prospect of adding a crypto module. But, for a customer, it might make all the difference if they can, for example, open an account in under a minute or get a line of credit without re-entering all of their information.

What ease means for a bank’s specific customer base will vary. As such, asking those questions and getting specific answers yourself will be key in determining exactly how to move forward. However, this survey data should offer a serious lesson to anyone who thinks they might be guilty of shiny object syndrome when it comes to their innovation efforts (as well as those who are confident they are not) — maybe it’s time to take a step back. Crypto is cool, but let’s start with the basics.