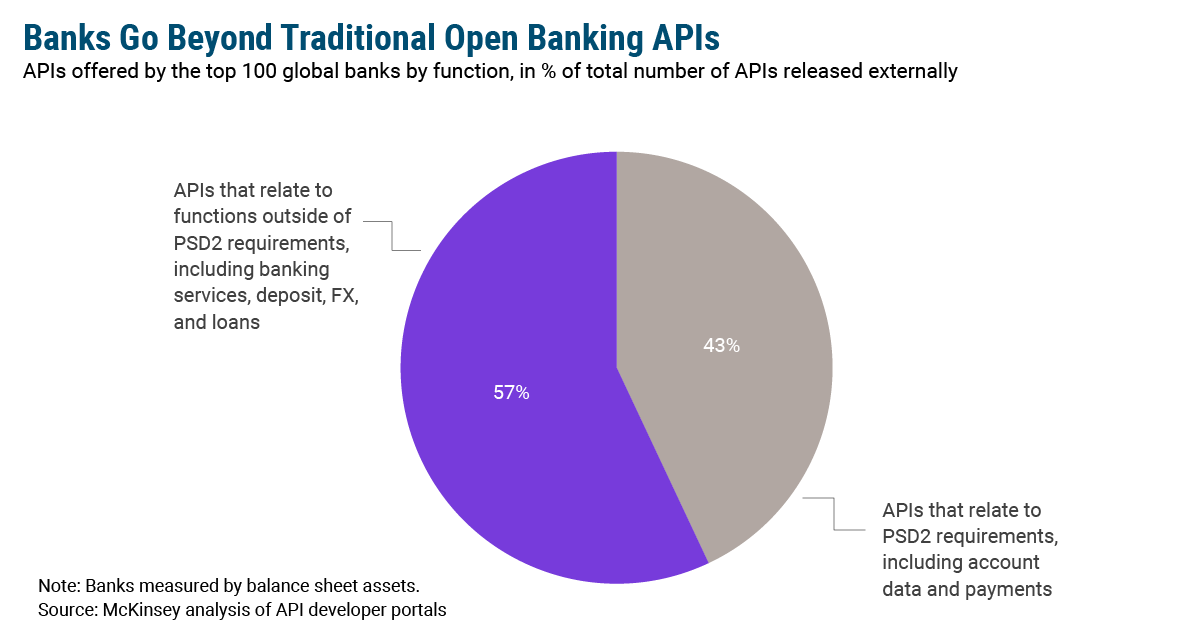

Banking institutions globally are quickly moving beyond traditional open banking mandates, according to an analysis of external application programming interfaces (APIs) offered by the world’s top 100 banks by McKinsey. The Revised Payment Services Directive (PSD2) in Europe laid out the initial concept with requirements stipulating that banks make customer data available to third parties at their request and enable payment transactions via third-party applications. But, just 43% of external APIs offered by banks today relate to these requirements, while 57% pertain to other, arguably more advanced functions. These additional functions include things like the ability to open an account or find a branch. The most important distinction here is that these additional APIs are not defined by regulation, meaning they are voluntary even in jurisdictions where specific open banking mandates exist.

The expansion of open banking beyond its original premise will give way to the sprawling financial services ecosystems of the future that many envision, as banks increasingly integrate with third parties to bring new services to market, faster. This data suggests that future may be closer than we think. To be fair — this analysis focused on the largest banks in the world, but given these institutions generally set the pace for the market and drive customer expectations, greater adoption probably isn’t that far behind. Appetite is certainly there: A whopping 92% of banks surveyed by Finastra in 2020 reported interest in using APIs to enable open banking capabilities in the next 12 months, up from just 69% in 2019.

Now, where to begin. Many executives are still trying to wrap their heads around the basic idea of open banking, let alone moving on to phase two. And, in the US, where there aren’t any mandates at all, it can be especially difficult to determine where to start. A good place is to take a look at your infrastructure and how well it supports your long-term goals. Are you interested only in providing secure data access to third parties? Do you want to get into Banking-as-a-Service (BaaS), which would require functionality like account opening? Once you’ve answered these questions, you can look at your technology stack and assess whether it can support those initiatives. Generally, how prepared your organization is to move forward will depend on your core. A next-gen core that is API-first will be much easier to integrate with than a legacy system, for instance. But defining your underlying strategy and mapping that to your capabilities is the first step. From there, you can begin to think through how to fill in the gaps.