Why Banks Switch Cores

April 6, 2023

By: Kate Drew

Banks and Core Conversion

Why do banks switch core platforms?

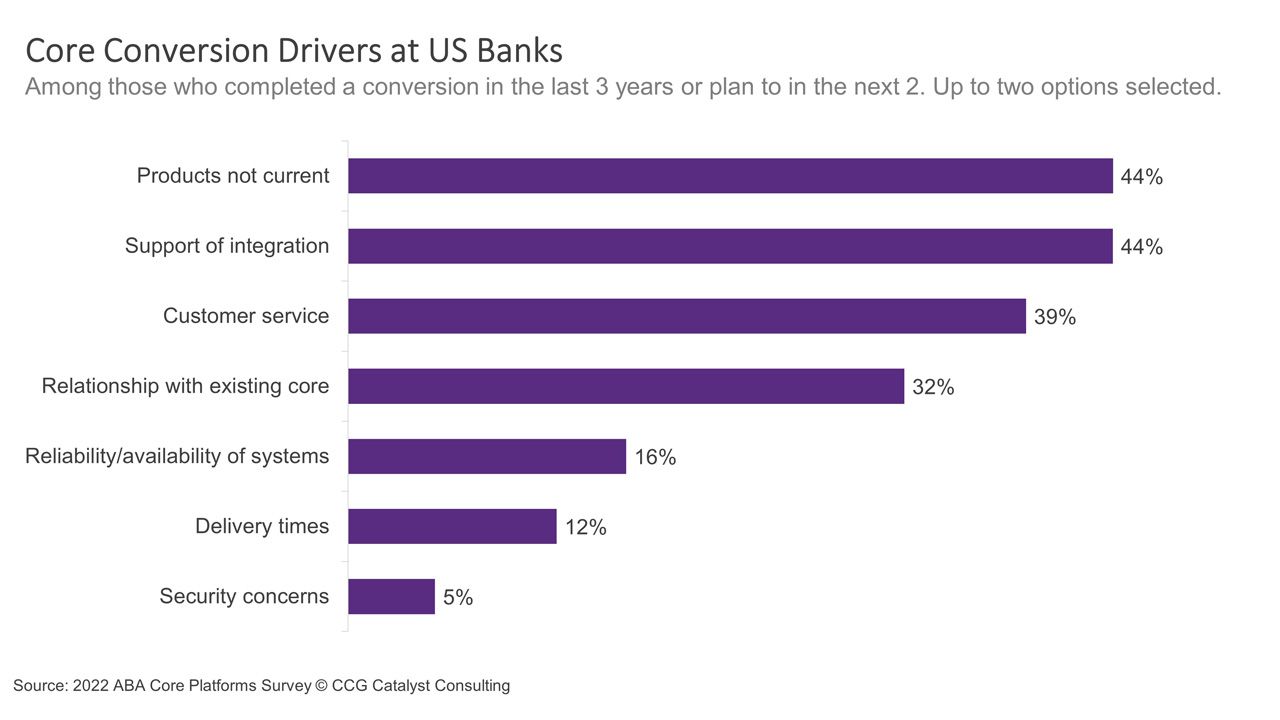

Last week, we took a look at the cost benefits of moving to a next-generation core banking platform. In this snapshot, we are diving into why banks pursue a core conversion outside of the cost conversation. Cost is a big deal, but functionality is too. So what exactly is it these institutions are looking for when making a jump? According to the 2022 ABA Core Platforms Survey, there are two drivers that stand out above the rest when it comes to why a bank would pursue a core conversion: products aren’t considered current and support of integration is lacking somehow.

These two drivers are inextricably linked in a couple of ways. First, they are both tied to the customer experience. And second, they both speak to a desire to pursue a best of breed strategy when compiling solutions, which has been growing more frequent. A best of breed approach to technology refers to when institutions shop around for the most suitable solutions for specific functions or use cases, rather than getting everything from a single vendor, a strategy generally termed best of suite. Ultimately, it seems as though what this data is really saying is that banks want modern technology solutions as well as the freedom to go out and find those solutions themselves, without worrying about how they’re going to get everything plugged in. Seems reasonable, right?

This again brings us back to flexibility. Banks today need flexible infrastructure in order to compete. And it makes sense that those pursuing core conversion initiatives are doing so with flexibility in mind. They know where we are headed. The concern, though, is that this group is relatively small — according to the ABA, only 21% of banks plan to switch providers at their next renewal, despite fewer than half (47%) of respondents expressing satisfaction with their current core. This suggests that there are still many institutions that have not yet woken up to the need for agility (or at least how critical that need is). Of course, there are other ways to achieve flexibility not specifically asked about in this study, and which we have discussed before. But if you’re an institution on a legacy platform not pursuing one of these paths, it may be worth asking why that is.

Against a backdrop characterized by intense competition and a need for differentiation, especially given the current climate, the ability to integrate is only going to grow more important. Moreover, this isn’t just about being able to use different solutions for your existing operations; it’s about being able to participate in completely new areas and getting ready for those that may be on the horizon — think embedded finance, for example. Flexibility is something we talk about often from an innovation standpoint. But the truth is it’s not a cutting-edge idea anymore. It’s baseline for making it to the future. And, as such, every bank needs a strategy for how to get there.